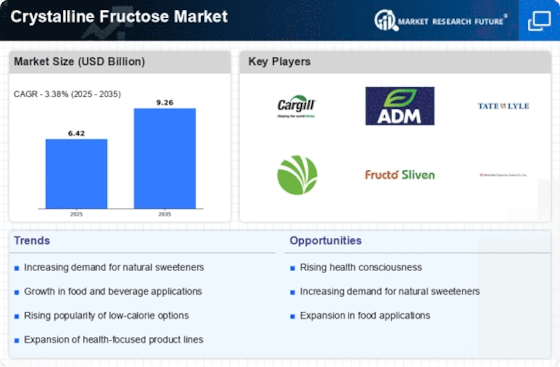

Rising Health Consciousness

The increasing awareness regarding health and wellness among consumers appears to be a pivotal driver for the crystalline fructose Market. As individuals become more discerning about their dietary choices, there is a noticeable shift towards low-calorie and natural sweeteners. Crystalline fructose, being derived from fruits, is perceived as a healthier alternative to traditional sugars. This trend is reflected in market data, which indicates a growing preference for products containing crystalline fructose, particularly in the beverage and food sectors. The demand for healthier sweetening options is likely to propel the market forward, as manufacturers respond to consumer preferences by incorporating crystalline fructose into their formulations.

Innovations in Food Technology

Technological advancements in food processing and formulation are playing a crucial role in shaping the Crystalline Fructose Market. Innovations that enhance the extraction and production processes of crystalline fructose are likely to improve efficiency and reduce costs. Furthermore, the development of new applications and formulations utilizing crystalline fructose is expected to expand its market reach. As food manufacturers increasingly adopt these technologies, the market for crystalline fructose may experience a surge in demand. The integration of advanced food technologies not only enhances product quality but also aligns with consumer trends towards healthier and more sustainable food options.

Regulatory Support for Natural Sweeteners

The regulatory landscape surrounding sweeteners is evolving, with a noticeable shift towards supporting natural alternatives like crystalline fructose. Governments and health organizations are increasingly promoting the use of natural sweeteners in food products, which could bolster the Crystalline Fructose Market. This regulatory support is often accompanied by guidelines that encourage manufacturers to reduce the use of artificial sweeteners, thereby creating a favorable environment for the adoption of crystalline fructose. As regulations continue to favor natural ingredients, the market for crystalline fructose is likely to benefit, as manufacturers seek to comply with these standards while meeting consumer demand for healthier options.

Versatile Applications in Food and Beverage

The versatility of crystalline fructose in various applications within the food and beverage sector significantly contributes to the growth of the Crystalline Fructose Market. This sweetener is utilized in a wide array of products, including soft drinks, baked goods, and dairy items, due to its ability to enhance flavor while maintaining lower caloric content. Market analysis suggests that the food and beverage industry accounts for a substantial share of the crystalline fructose market, with projections indicating continued expansion. As manufacturers seek to innovate and meet consumer demands for healthier options, the incorporation of crystalline fructose is likely to increase, further solidifying its role in diverse culinary applications.

Growing Demand for Low Glycemic Index Products

The rising consumer preference for low glycemic index (GI) products is emerging as a significant driver for the Crystalline Fructose Market. Crystalline fructose has a lower GI compared to regular sugar, making it an appealing choice for individuals managing blood sugar levels. This trend is particularly relevant in the context of increasing incidences of diabetes and obesity, where consumers are actively seeking alternatives that do not spike blood sugar levels. Market data indicates that products featuring crystalline fructose are gaining traction among health-conscious consumers, suggesting a potential for growth in this segment. As awareness of the benefits of low GI sweeteners continues to spread, the demand for crystalline fructose is expected to rise.