Expansion in Research Applications

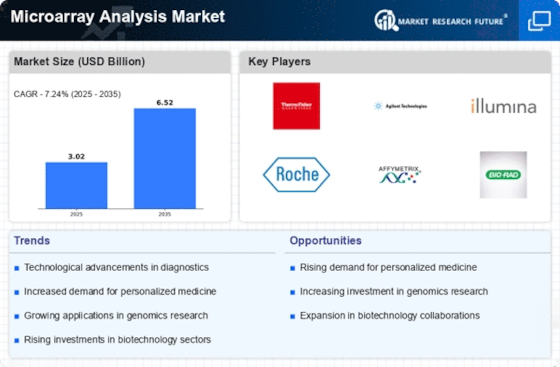

The Microarray Analysis Market is witnessing an expansion in research applications across various fields, including genomics, transcriptomics, and proteomics. Researchers are increasingly adopting microarray technology for its ability to analyze gene expression patterns and identify biomarkers for diseases. This trend is supported by funding from governmental and private sectors, which is aimed at advancing research capabilities. The market is projected to grow as more academic and research institutions integrate microarray analysis into their studies. By 2025, the market could see an increase in research-related expenditures, potentially reaching USD 2.5 billion, as the demand for comprehensive genomic data continues to rise.

Growing Investments in Biotechnology

The Microarray Analysis Market is benefiting from growing investments in biotechnology. As biopharmaceutical companies and research institutions allocate more resources towards innovative technologies, microarray analysis is becoming a focal point for drug discovery and development. The increasing number of collaborations between academic institutions and biotech firms is likely to enhance the application of microarray technology in various research projects. This trend is expected to drive market growth, with investments projected to increase by 15% over the next few years. Such financial backing is crucial for advancing microarray technologies and expanding their applications in clinical settings.

Rising Demand for Personalized Medicine

The Microarray Analysis Market is significantly influenced by the rising demand for personalized medicine. As healthcare shifts towards more individualized treatment plans, microarray technology plays a pivotal role in understanding genetic variations and their implications for disease treatment. This trend is particularly evident in oncology, where microarrays are utilized to tailor therapies based on a patient's genetic profile. The market is expected to witness a surge in demand, with estimates suggesting a growth rate of 12% annually over the next five years. This increase is driven by the need for precise diagnostics and targeted therapies, which microarray analysis facilitates effectively.

Increasing Awareness of Genetic Disorders

The Microarray Analysis Market is also influenced by the increasing awareness of genetic disorders among healthcare professionals and the general public. As knowledge about the genetic basis of diseases expands, there is a growing demand for diagnostic tools that can provide insights into genetic abnormalities. Microarray analysis offers a comprehensive approach to identifying these disorders, making it an essential tool in clinical diagnostics. The market is likely to experience growth as healthcare providers adopt microarray technology to enhance patient care. Projections indicate that the market could grow by 10% annually, driven by the need for effective genetic testing solutions.

Technological Advancements in Microarray Analysis

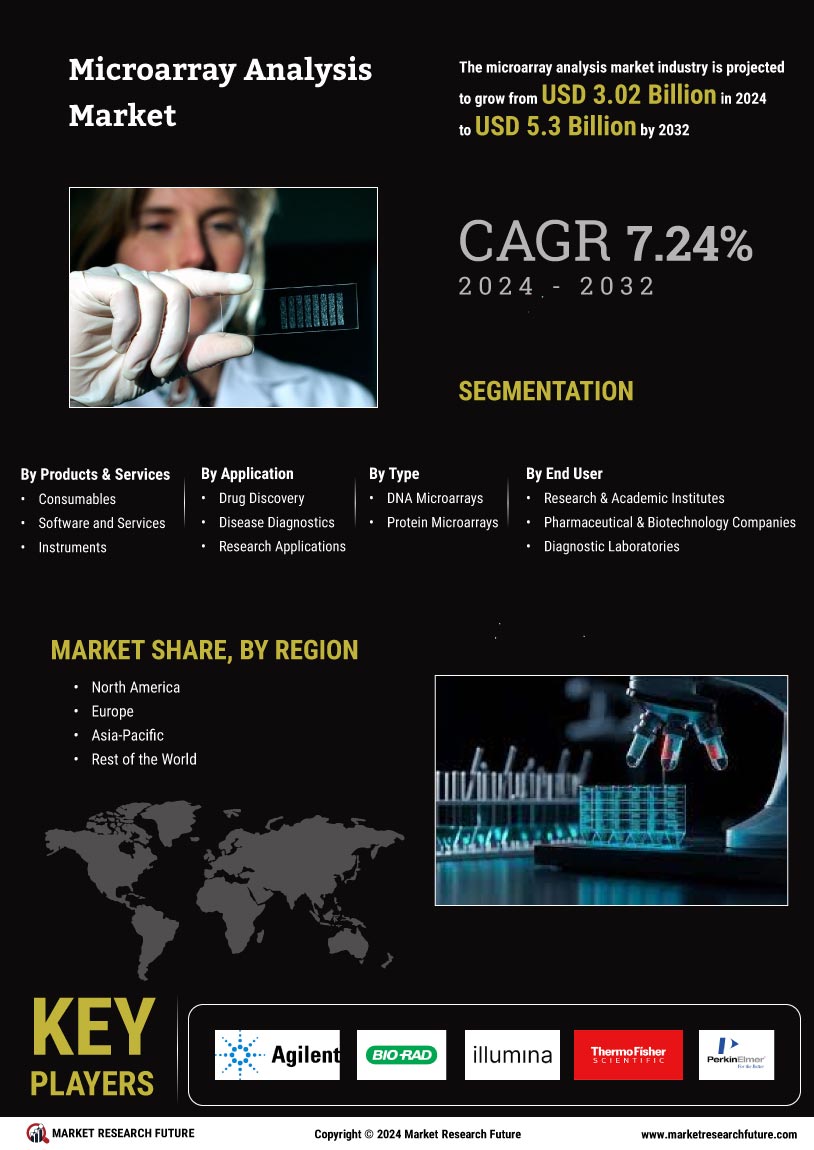

The Microarray Analysis Market is experiencing rapid technological advancements that enhance the capabilities and efficiency of microarray platforms. Innovations such as high-throughput sequencing and improved data analysis algorithms are driving the market forward. These advancements allow for more accurate and faster results, which are crucial for research and clinical applications. The integration of artificial intelligence and machine learning into microarray data interpretation is also gaining traction, potentially increasing the market's value. As of 2025, the market is projected to reach a valuation of approximately USD 3 billion, reflecting a compound annual growth rate of around 10%. This growth is indicative of the increasing reliance on microarray technology in genomics and proteomics research.