Growth of Renewable Energy Sector

The expansion of the renewable energy sector is emerging as a significant driver for the Glass Wafer Carrier Market. With the increasing adoption of solar energy technologies, particularly photovoltaic cells, the demand for high-quality silicon wafers is on the rise. The solar energy market is anticipated to grow at a compound annual growth rate of over 20% in the coming years. This growth directly impacts the need for efficient wafer handling solutions, as glass wafer carriers are essential for maintaining the quality and integrity of solar wafers during manufacturing. As the renewable energy sector continues to flourish, the Glass Wafer Carrier Market is likely to benefit from this upward trend.

Focus on Automation and Efficiency

The emphasis on automation and operational efficiency in semiconductor manufacturing is a crucial driver for the Glass Wafer Carrier Market. As manufacturers strive to reduce costs and enhance productivity, the integration of automated systems becomes increasingly prevalent. Glass wafer carriers play a vital role in these automated processes, facilitating the seamless transfer of wafers between different stages of production. The market for automated semiconductor manufacturing equipment is projected to grow significantly, with investments in robotics and AI technologies. This trend suggests that the Glass Wafer Carrier Market will continue to expand as manufacturers seek to implement more efficient and automated solutions.

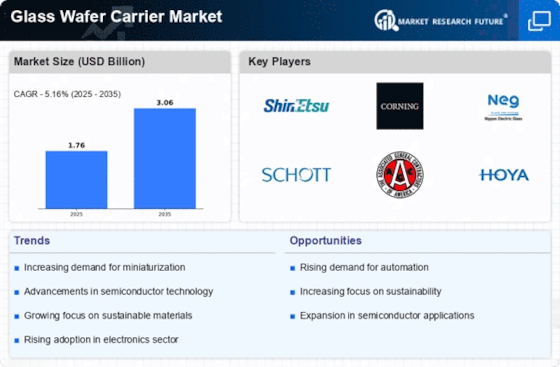

Rising Demand for Semiconductor Devices

The increasing demand for semiconductor devices is a primary driver for the Glass Wafer Carrier Market. As industries such as automotive, consumer electronics, and telecommunications expand, the need for advanced semiconductor components grows. In 2025, the semiconductor market is projected to reach approximately 600 billion USD, indicating a robust growth trajectory. This surge necessitates efficient and reliable wafer handling solutions, which glass wafer carriers provide. Their ability to protect delicate wafers during transport and processing is crucial in maintaining the integrity of semiconductor manufacturing. Consequently, the Glass Wafer Carrier Market is likely to experience significant growth as manufacturers seek to optimize their production processes and meet the escalating demand for high-performance electronic devices.

Advancements in Wafer Fabrication Technologies

Technological advancements in wafer fabrication are significantly influencing the Glass Wafer Carrier Market. Innovations such as 3D integration and miniaturization of electronic components require precise handling and transport of wafers. The introduction of new materials and processes in semiconductor manufacturing enhances the need for specialized carriers that can accommodate these changes. For instance, the shift towards larger wafer sizes, such as 300mm, necessitates carriers that can ensure stability and minimize contamination. As these fabrication technologies evolve, the Glass Wafer Carrier Market is expected to adapt, providing solutions that meet the stringent requirements of modern semiconductor production.

Increasing Investment in Research and Development

The rising investment in research and development within the semiconductor industry is a notable driver for the Glass Wafer Carrier Market. Companies are allocating substantial resources to innovate and improve wafer processing technologies. This focus on R&D is essential for developing new materials and processes that enhance wafer performance and reliability. As the semiconductor industry evolves, the demand for advanced glass wafer carriers that can support these innovations is likely to increase. The commitment to R&D indicates a long-term growth trajectory for the Glass Wafer Carrier Market, as manufacturers seek to stay competitive in a rapidly changing technological landscape.