Rising Prevalence of Gigantism

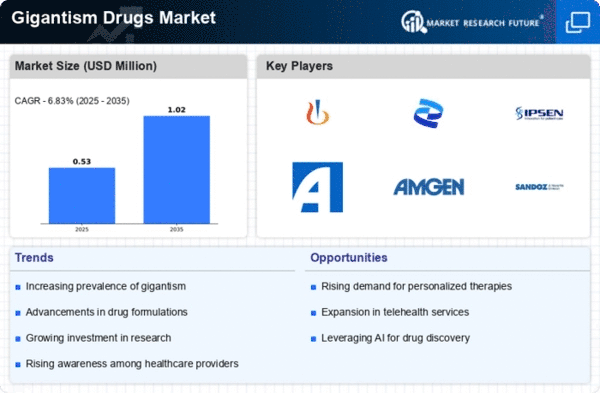

The Global Gigantism Drugs Market Industry is experiencing growth due to the increasing prevalence of gigantism and related disorders. As awareness of these conditions rises, more patients are being diagnosed and treated. In 2024, the market is projected to reach 750 USD Million, reflecting a growing need for effective therapeutic options. This trend is further supported by advancements in diagnostic technologies, which enable earlier detection and intervention. The increasing number of endocrinologists and specialized clinics contributes to a more robust treatment landscape, thereby driving demand for gigantism drugs.

Growing Awareness and Education

Public awareness and education regarding gigantism and its treatment options are crucial drivers of the Global Gigantism Drugs Market Industry. Campaigns aimed at educating both healthcare professionals and the general public about the symptoms and implications of gigantism are gaining traction. Increased knowledge leads to earlier diagnosis and treatment, which is essential for effective management of the condition. As awareness grows, more patients are likely to seek medical advice, thereby increasing the demand for gigantism drugs. This trend is expected to play a significant role in shaping the market landscape in the coming years.

Regulatory Support and Approval

The Global Gigantism Drugs Market Industry is influenced by supportive regulatory frameworks that facilitate the approval of new treatments. Regulatory bodies are increasingly recognizing the need for effective therapies for rare conditions like gigantism, leading to expedited review processes for promising drugs. This regulatory support encourages pharmaceutical companies to invest in research and development, resulting in a more diverse range of treatment options. As new drugs enter the market, competition increases, which may lead to improved pricing and accessibility for patients, ultimately benefiting the overall market.

Advancements in Drug Development

Innovations in pharmaceutical research are propelling the Global Gigantism Drugs Market Industry forward. Recent developments in targeted therapies and biologics are enhancing treatment efficacy and safety profiles. For instance, the introduction of somatostatin analogs has shown promising results in managing growth hormone levels. These advancements not only improve patient outcomes but also expand the therapeutic options available to healthcare providers. As the industry continues to evolve, the market is expected to grow significantly, potentially reaching 1500 USD Million by 2035, with a compound annual growth rate of 6.5% from 2025 to 2035.

Increased Healthcare Expenditure

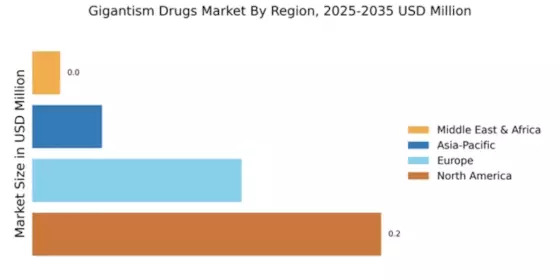

The Global Gigantism Drugs Market Industry is benefiting from rising healthcare expenditures across various regions. Governments and private sectors are investing more in healthcare infrastructure, which includes the treatment of rare diseases like gigantism. This increase in funding allows for better access to medications and treatment facilities, thereby improving patient care. As healthcare systems evolve, the availability of specialized drugs for gigantism is likely to improve, fostering a more favorable environment for market growth. This trend is expected to contribute to the market's expansion, aligning with the projected growth trajectory.