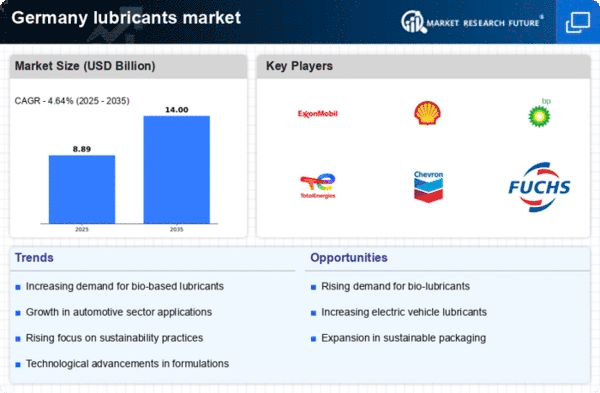

The lubricants market in Germany exhibits a competitive landscape characterized by a blend of established multinational corporations and regional players. Key growth drivers include the increasing demand for high-performance lubricants, driven by advancements in automotive technology and industrial applications. Major companies such as ExxonMobil (US), Shell (GB), and Fuchs Petrolub (DE) are strategically positioned to leverage innovation and sustainability initiatives. ExxonMobil (US) focuses on enhancing its product portfolio through research and development, while Shell (GB) emphasizes digital transformation and customer-centric solutions. Fuchs Petrolub (DE), a local leader, capitalizes on its deep understanding of regional market dynamics, thereby shaping the competitive environment through tailored offerings.In terms of business tactics, companies are increasingly localizing manufacturing to reduce lead times and optimize supply chains. The market structure appears moderately fragmented, with a few dominant players exerting considerable influence. This fragmentation allows for niche players to thrive, yet the collective strength of major companies like BP (GB) and TotalEnergies (FR) ensures that competition remains robust. The strategic focus on supply chain optimization and localized production is likely to enhance operational efficiency across the sector.

In October Shell (GB) announced a partnership with a leading technology firm to develop AI-driven predictive maintenance solutions for industrial lubricants. This strategic move is significant as it positions Shell at the forefront of digital innovation, potentially enhancing customer engagement and operational efficiency. By integrating AI into its product offerings, Shell aims to provide clients with tailored solutions that anticipate maintenance needs, thereby reducing downtime and costs.

In September Fuchs Petrolub (DE) expanded its production capacity in Germany by investing €50 million in a new facility. This expansion reflects Fuchs' commitment to meeting the growing demand for high-quality lubricants in the automotive and industrial sectors. The investment not only strengthens Fuchs' market position but also underscores its focus on sustainability, as the new facility is designed to operate with reduced environmental impact.

In August BP (GB) launched a new line of bio-based lubricants aimed at reducing carbon emissions in industrial applications. This initiative aligns with BP's broader sustainability goals and responds to increasing regulatory pressures for environmentally friendly products. The introduction of bio-based options may attract a new customer segment that prioritizes sustainability, thereby enhancing BP's competitive edge in the market.

As of November current trends in the lubricants market are increasingly defined by digitalization, sustainability, and the integration of advanced technologies such as AI. Strategic alliances are becoming more prevalent, enabling companies to pool resources and expertise to innovate more effectively. The competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, technology, and supply chain reliability. Companies that can successfully navigate these trends will likely secure a stronger foothold in the market.