Growing Demand for Data Centers

The fiber optic-components market in Germany is significantly impacted by the growing demand for data centers. As businesses increasingly rely on cloud computing and data storage solutions, the need for efficient data transmission becomes critical. In 2025, the number of data centers in Germany is expected to rise by approximately 20%, leading to heightened demand for fiber optic components. These components are vital for ensuring high-speed connectivity and reliable data transfer within and between data centers. The trend towards virtualization and the expansion of big data analytics further contribute to this demand, as organizations seek to optimize their operations. As a result, manufacturers in the fiber optic-components market are likely to experience increased orders and a need for innovative solutions to meet the evolving requirements of data centers.

Rising Adoption of Smart Technologies

The fiber optic-components market is witnessing a notable increase in demand due to the rising adoption of smart technologies in Germany. As industries integrate IoT devices, smart grids, and automation systems, the need for reliable and high-speed data transmission becomes paramount. Fiber optic components are essential for supporting these technologies, as they offer superior bandwidth and lower latency compared to traditional copper solutions. By 2025, the market for smart technologies is projected to grow by over 15%, driving further investments in fiber optic infrastructure. This trend indicates a shift towards more interconnected systems, where fiber optics play a crucial role in ensuring seamless communication. Consequently, the fiber optic-components market is likely to expand as businesses seek to implement smart solutions that rely on advanced fiber optic technologies.

Technological Advancements in Fiber Optics

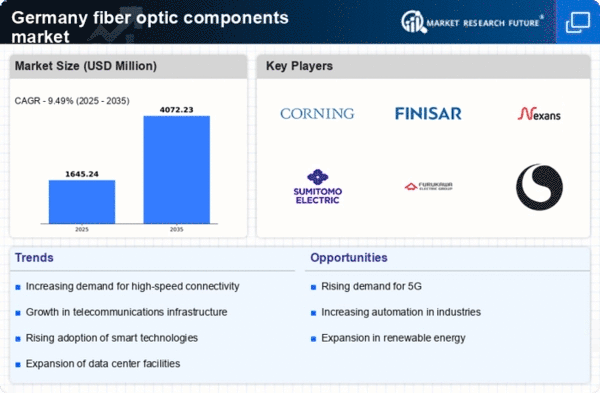

The fiber optic-components market in Germany is experiencing a surge due to rapid technological advancements. Innovations in fiber optic technology, such as improved light transmission and enhanced durability, are driving demand. The introduction of new materials and manufacturing techniques has led to the production of more efficient components, which are essential for high-speed data transmission. As of 2025, the market is projected to grow at a CAGR of approximately 8.5%, reflecting the increasing reliance on fiber optics in telecommunications and data centers. This growth is further supported by the rising need for bandwidth and the expansion of 5G networks, which necessitate advanced fiber optic solutions. Consequently, companies are investing heavily in research and development to stay competitive in the fiber optic-components market.

Focus on Energy Efficiency and Sustainability

In Germany, the fiber optic components market is increasingly influenced by a focus on energy efficiency and sustainability. As environmental concerns grow, companies are seeking to reduce their carbon footprint and improve energy consumption in their operations. Fiber optic technology is inherently more energy-efficient than traditional copper wiring, making it an attractive option for businesses aiming to enhance sustainability. In 2025, it is anticipated that the demand for energy-efficient fiber optic components will rise by 30%, driven by regulatory pressures and consumer preferences for greener solutions. This shift not only supports environmental goals but also aligns with the broader trend of sustainable manufacturing practices. Consequently, the fiber optic-components market is likely to benefit from this emphasis on sustainability, as manufacturers innovate to produce eco-friendly products.

Increased Investment in Telecommunications Infrastructure

Germany's fiber optic-components market is significantly influenced by increased investment in telecommunications infrastructure. The government and private sector are allocating substantial funds to enhance connectivity across urban and rural areas. In 2025, investments in fiber optic networks are expected to exceed €10 billion, aimed at expanding broadband access and improving service quality. This influx of capital is likely to stimulate demand for fiber optic components, as network operators seek to upgrade existing systems and deploy new technologies. The emphasis on building robust telecommunications infrastructure aligns with Germany's digitalization goals, which further propels the fiber optic-components market. As a result, manufacturers are poised to benefit from this trend, as they supply the necessary components to support the growing infrastructure.