Regulatory Compliance

Regulatory compliance is a significant driver in the Germany facility management market. The German government enforces strict regulations regarding health, safety, and environmental standards that facility management companies must adhere to. Compliance with these regulations is not only a legal obligation but also a competitive advantage. For instance, the introduction of the Energy Efficiency Act mandates that organizations implement energy-saving measures, which has led to an increased demand for facility management services that ensure compliance. This regulatory landscape compels facility managers to stay updated with changing laws and standards, thereby driving the growth of the industry as companies seek to mitigate risks associated with non-compliance.

Workplace Flexibility

The trend towards workplace flexibility is reshaping the Germany facility management market. As organizations adapt to changing workforce dynamics, there is a growing need for flexible workspace solutions that cater to diverse employee needs. This shift is evidenced by the rise of co-working spaces and hybrid work models, which require facility management services that can accommodate fluctuating occupancy levels. According to recent studies, companies that implement flexible work environments report a 25 percent increase in employee satisfaction. Consequently, facility management providers are increasingly offering tailored solutions that enhance workplace adaptability, thereby driving demand within the industry.

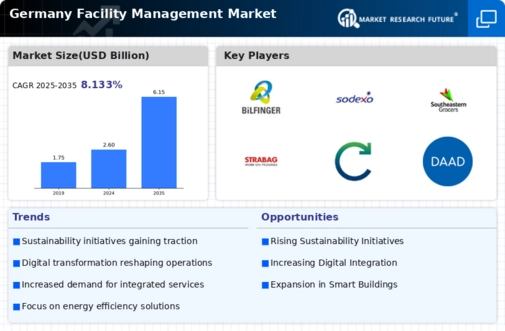

Sustainability Initiatives

Sustainability has emerged as a crucial driver in the Germany facility management market. With stringent environmental regulations and a growing emphasis on corporate social responsibility, organizations are increasingly seeking sustainable facility management practices. The German government has implemented various policies aimed at reducing carbon emissions, which has led to a surge in demand for green building certifications and energy-efficient solutions. For example, the implementation of energy management systems can lead to a reduction in energy consumption by approximately 20 percent. This focus on sustainability not only enhances the reputation of organizations but also aligns with the broader goals of the European Union to achieve climate neutrality by 2050, thus influencing the facility management sector significantly.

Technological Advancements

The integration of advanced technologies in the Germany facility management market is a pivotal driver. The adoption of Internet of Things (IoT) devices, artificial intelligence, and automation tools enhances operational efficiency and reduces costs. For instance, smart building technologies allow for real-time monitoring of energy consumption, leading to potential savings of up to 30 percent in operational costs. Furthermore, the increasing reliance on data analytics enables facility managers to make informed decisions, optimizing resource allocation and improving service delivery. As organizations in Germany continue to embrace digital transformation, the demand for technologically advanced facility management solutions is expected to grow, thereby shaping the future landscape of the industry.

Economic Growth and Urbanization

Economic growth and urbanization are key drivers influencing the Germany facility management market. As Germany's economy continues to expand, urban areas are experiencing significant population growth, leading to increased demand for commercial and residential spaces. This urbanization trend necessitates efficient facility management services to maintain and operate these properties effectively. The construction sector in Germany has seen a notable increase, with a projected growth rate of 3.5 percent annually. Consequently, facility management companies are positioned to capitalize on this growth by providing essential services that ensure the sustainability and functionality of urban infrastructures, thereby contributing to the overall development of the industry.