Evolving Consumer Preferences

The electric vehicle-ev-insurance market is shaped by evolving consumer preferences, particularly among younger generations who prioritize sustainability and technology. Surveys indicate that over 60% of millennials and Gen Z consumers express a strong interest in electric vehicles, viewing them as a viable alternative to traditional combustion engines. This demographic shift is prompting insurers to develop innovative products that cater to the unique needs of electric vehicle owners. For instance, insurance policies that offer incentives for eco-friendly driving habits or discounts for using public charging stations are becoming increasingly popular. As consumer preferences continue to evolve, the electric vehicle-ev-insurance market is likely to see a diversification of insurance offerings that align with the values of environmentally conscious consumers.

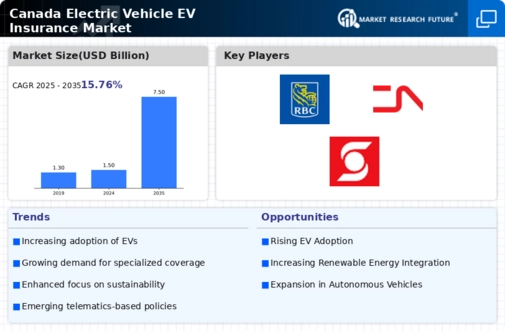

Rising Electric Vehicle Adoption

The electric vehicle-ev-insurance market is experiencing a notable surge in adoption rates across Canada. As of 2025, electric vehicle sales account for approximately 20% of all new vehicle registrations, reflecting a growing consumer preference for sustainable transportation. This shift is driven by increasing environmental awareness and advancements in electric vehicle technology, which enhance performance and reduce costs. Consequently, the demand for specialized insurance products tailored to electric vehicles is on the rise. Insurers are adapting their offerings to meet the unique needs of electric vehicle owners, such as coverage for battery replacement and charging equipment. This trend indicates a significant opportunity for growth within the electric vehicle-ev-insurance market, as more consumers seek insurance solutions that align with their eco-friendly choices.

Government Support and Incentives

The electric vehicle insurance market is significantly influenced by government support and incentives aimed at promoting electric vehicle adoption. Canadian federal and provincial governments have implemented various programs, including rebates and tax credits, to encourage consumers to purchase electric vehicles. As of 2025, these incentives can reduce the upfront cost of electric vehicles by up to $5,000, making them more accessible to a broader audience. This governmental backing not only stimulates electric vehicle sales but also creates a favorable environment for the electric vehicle-ev-insurance market. Insurers are likely to respond by developing products that align with these incentives, such as policies that offer additional coverage for vehicles purchased through government programs. This synergy between government initiatives and insurance offerings may enhance market growth.

Environmental Regulations and Standards

The electric vehicle-ev-insurance market is increasingly affected by stringent environmental regulations and standards set by Canadian authorities. As the government aims to reduce greenhouse gas emissions, regulations are being introduced that mandate a transition to electric vehicles. By 2035, all new light-duty vehicles sold in Canada are expected to be zero-emission, which will significantly impact the automotive landscape. This regulatory environment is likely to drive up the demand for electric vehicles, subsequently increasing the need for specialized insurance products. Insurers must adapt to these changes by offering policies that address the unique risks associated with electric vehicles, such as battery-related issues and charging infrastructure. The evolving regulatory framework presents both challenges and opportunities for the electric vehicle-ev-insurance market.

Technological Advancements in Vehicle Safety

The electric vehicle-ev-insurance market is influenced by rapid technological advancements in vehicle safety features. Many electric vehicles are equipped with cutting-edge safety technologies, such as advanced driver-assistance systems (ADAS) and autonomous driving capabilities. These innovations not only enhance the safety of electric vehicles but also impact insurance premiums. Insurers are increasingly recognizing that vehicles with superior safety features may pose lower risks, potentially leading to reduced insurance costs for consumers. In Canada, the integration of these technologies is expected to drive a shift in underwriting practices, as insurers adjust their risk assessments based on the enhanced safety profiles of electric vehicles. This evolution in vehicle safety is likely to create a more competitive landscape within the electric vehicle-ev-insurance market.