Regulatory Support and Policy Frameworks

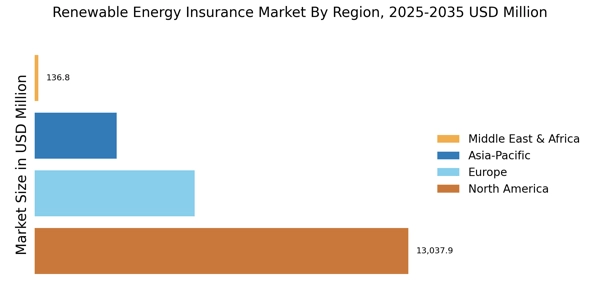

The Renewable Energy Insurance Market is significantly influenced by supportive regulatory frameworks and policies that promote renewable energy adoption. Governments worldwide are implementing policies that incentivize the development of renewable energy sources, such as wind and solar. These policies often include tax credits, subsidies, and renewable energy mandates, which create a favorable environment for investment. As a result, the demand for insurance products that cover renewable energy projects is likely to increase. Insurers are responding by enhancing their product offerings to align with regulatory requirements, thereby ensuring that projects are adequately protected against potential risks. This alignment between insurance products and regulatory frameworks is crucial for fostering a stable and sustainable renewable energy market.

Expansion of Renewable Energy Technologies

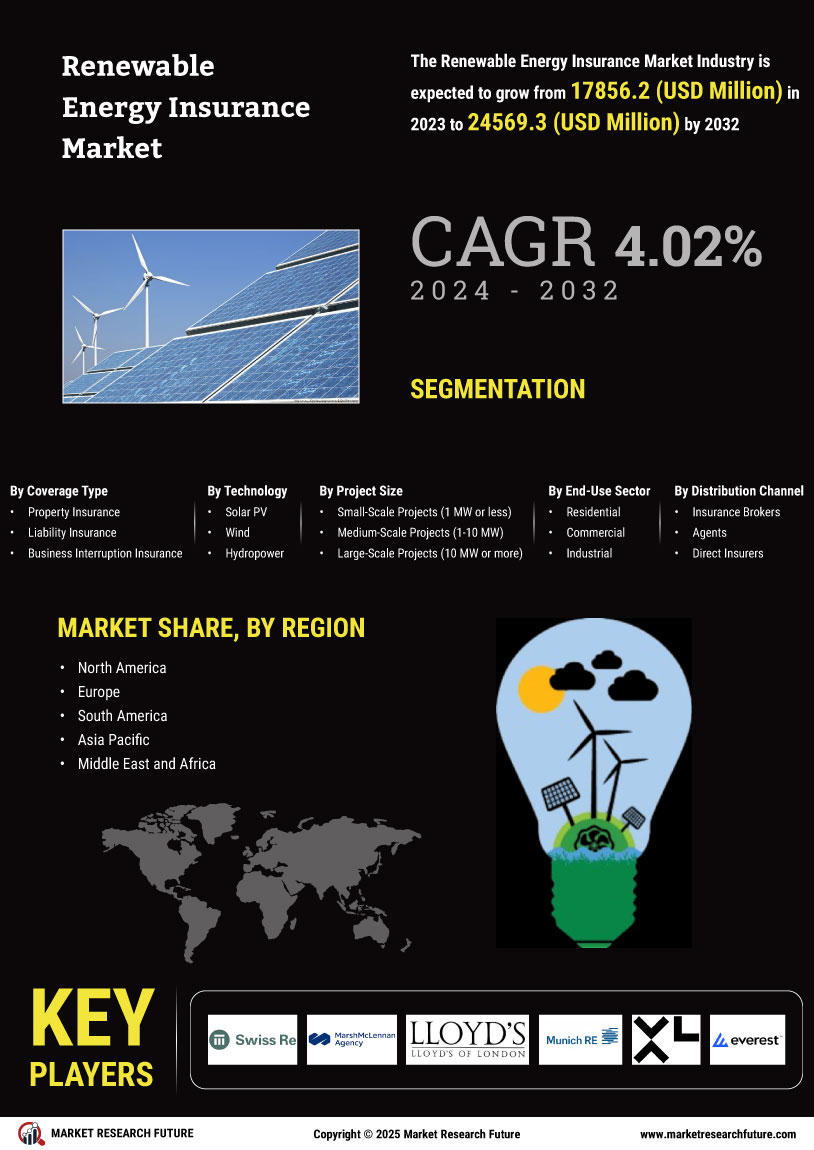

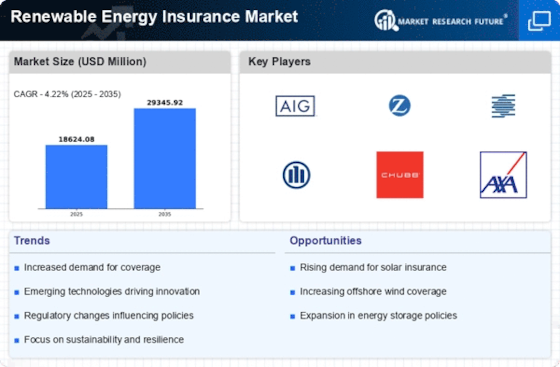

The Renewable Energy Insurance Market is benefiting from the rapid expansion of renewable energy technologies, including solar, wind, and battery storage. As these technologies become more prevalent, the need for specialized insurance coverage grows. In 2025, the market for renewable energy technologies is expected to expand significantly, driven by advancements in efficiency and cost-effectiveness. This expansion presents opportunities for insurers to develop innovative products that cater to the unique risks associated with each technology. Furthermore, as new technologies emerge, insurers are likely to adapt their underwriting criteria and risk assessment methodologies to ensure comprehensive coverage. This dynamic environment fosters a competitive landscape within the Renewable Energy Insurance Market, encouraging insurers to enhance their offerings and better serve the needs of renewable energy stakeholders.

Increasing Awareness of Climate Change Risks

The Renewable Energy Insurance Market is increasingly shaped by the growing awareness of climate change risks among businesses and consumers. As the impacts of climate change become more pronounced, stakeholders are recognizing the importance of transitioning to renewable energy sources. This heightened awareness drives demand for insurance products that protect against climate-related risks, such as extreme weather events and regulatory changes. Insurers are responding by developing specialized coverage options that address these emerging risks, thereby enhancing the resilience of renewable energy projects. The focus on climate change not only influences purchasing decisions but also encourages collaboration between insurers and renewable energy developers to create comprehensive risk management strategies that align with sustainability goals.

Technological Advancements in Risk Management

The Renewable Energy Insurance Market is witnessing a transformation due to technological advancements that enhance risk management practices. Innovations such as data analytics, artificial intelligence, and machine learning are being integrated into the insurance sector, allowing for more accurate risk assessments and pricing models. These technologies enable insurers to analyze vast amounts of data related to renewable energy projects, leading to improved underwriting processes. As a result, insurers can offer more competitive premiums and tailored coverage options that reflect the unique risk profiles of renewable energy ventures. This technological integration not only streamlines operations but also enhances the overall efficiency of the insurance market, making it more responsive to the evolving needs of renewable energy stakeholders.

Growing Investment in Renewable Energy Projects

The Renewable Energy Insurance Market is experiencing a surge in investment as countries and corporations increasingly prioritize sustainable energy solutions. In 2025, investments in renewable energy projects are projected to reach unprecedented levels, driven by government incentives and corporate sustainability goals. This influx of capital necessitates robust insurance solutions to mitigate risks associated with project development and operation. As a result, insurers are adapting their offerings to cater to the unique needs of renewable energy projects, ensuring comprehensive coverage against potential liabilities. The growing investment landscape not only enhances the demand for insurance products but also encourages innovation within the industry, as insurers seek to develop tailored solutions that address the specific risks inherent in renewable energy ventures.