Cost Competitiveness

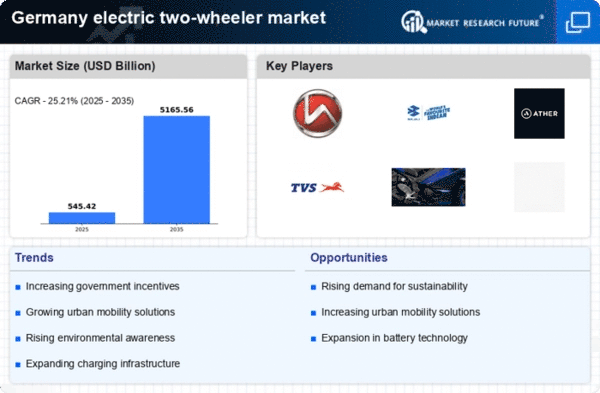

The electric two-wheeler market in Germany is witnessing a shift towards cost competitiveness, which is becoming a crucial driver for consumer adoption. The total cost of ownership for electric two-wheelers is increasingly favorable compared to conventional gasoline-powered models. With the average cost of electricity being approximately €0.30 per kWh, the operational expenses for electric two-wheelers are significantly lower. Furthermore, advancements in battery technology have led to a decrease in manufacturing costs, making electric models more affordable for consumers. As of 2025, the price gap between electric and traditional two-wheelers is narrowing, with electric models expected to account for 25% of total two-wheeler sales in Germany. This trend suggests that as prices continue to decline, the electric two-wheeler market will likely experience accelerated growth.

Urban Mobility Solutions

The electric two-wheeler market in Germany is significantly influenced by the evolving landscape of urban mobility solutions. As cities become increasingly congested, the demand for efficient and compact transportation options is on the rise. Electric two-wheelers offer a practical solution, allowing riders to navigate through traffic with ease. According to recent data, urban areas in Germany are projected to see a 30% increase in two-wheeler usage by 2027, driven by the need for quick and flexible commuting options. Additionally, the integration of electric two-wheelers into public transport systems is gaining traction, with cities exploring shared mobility initiatives. This trend not only enhances accessibility but also promotes the adoption of electric two-wheelers as a viable alternative to traditional vehicles, thereby expanding the market.

Infrastructure Development

The electric two-wheeler market in Germany is being bolstered by ongoing infrastructure development, particularly in charging networks. The government has recognized the necessity of a robust charging infrastructure to support the growing number of electric vehicles on the road. As of November 2025, Germany has over 50,000 public charging points, with plans to increase this number significantly in the coming years. This expansion is crucial for alleviating range anxiety among potential electric two-wheeler users. Moreover, the integration of fast-charging stations in urban areas is expected to enhance the convenience of owning an electric two-wheeler. The development of a comprehensive charging network not only supports current users but also encourages new consumers to consider electric two-wheelers as a viable option, thereby driving market growth.

Rising Environmental Awareness

The electric two-wheeler market in Germany is experiencing a notable surge in demand, driven by increasing environmental consciousness among consumers. As awareness of climate change and air pollution grows, individuals are seeking sustainable transportation alternatives. The German government has set ambitious targets to reduce greenhouse gas emissions, aiming for a 55% reduction by 2030 compared to 1990 levels. This commitment encourages consumers to opt for electric two-wheelers, which produce zero tailpipe emissions. Furthermore, studies indicate that electric two-wheelers can reduce urban noise pollution by up to 50%, making them an attractive option for city dwellers. The combination of environmental awareness and government initiatives is likely to propel the electric two-wheeler market forward, as more individuals prioritize eco-friendly choices in their daily commutes.

Government Regulations and Policies

The electric two-wheeler market in Germany is significantly shaped by government regulations and policies aimed at promoting electric mobility. The German government has implemented various measures, including subsidies and tax incentives, to encourage the adoption of electric vehicles. For instance, buyers of electric two-wheelers can benefit from a subsidy of up to €1,500, which lowers the initial purchase cost. Additionally, stringent emissions regulations are pushing manufacturers to innovate and produce more electric models. As of 2025, it is estimated that over 40% of new two-wheeler registrations in Germany are electric, reflecting the impact of these policies. The regulatory environment is likely to continue evolving, further supporting the growth of the electric two-wheeler market as the country transitions towards a more sustainable transportation system.