Government Regulations and Support

Government regulations and support are pivotal in driving the Electric Two Wheeler Charging Station Market. Many governments are implementing stringent emission regulations, which encourage the transition from traditional vehicles to electric alternatives. In addition, various countries are offering incentives such as tax rebates and subsidies for electric vehicle purchases, which indirectly boost the demand for electric two wheelers and their charging infrastructure. For example, in 2025, it is anticipated that government initiatives will lead to the installation of over 100,000 new charging stations worldwide. This regulatory support not only facilitates the growth of the Electric Two Wheeler Charging Station Market but also fosters a favorable environment for manufacturers and service providers to invest in charging infrastructure.

Rising Demand for Electric Two Wheelers

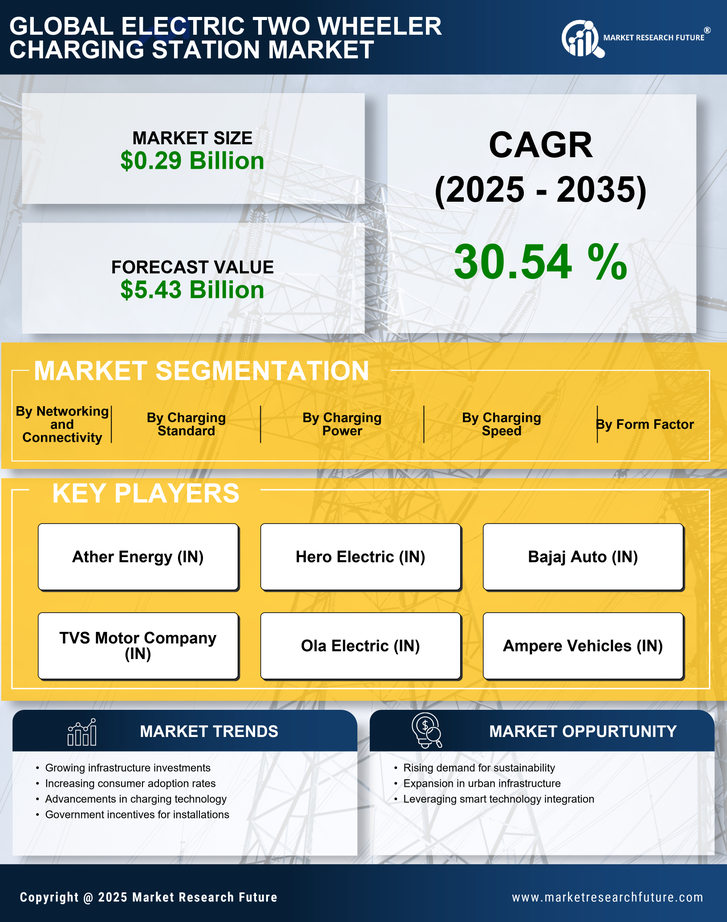

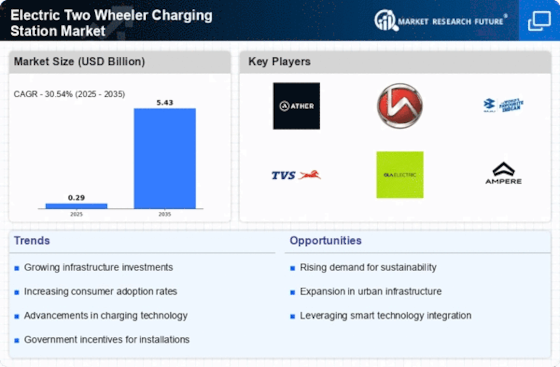

The increasing demand for electric two wheelers is a primary driver for the Electric Two Wheeler Charging Station Market. As consumers become more environmentally conscious, the shift towards electric vehicles is evident. In 2025, the sales of electric two wheelers are projected to reach approximately 10 million units, reflecting a compound annual growth rate of around 20%. This surge in demand necessitates a corresponding expansion in charging infrastructure, as users require convenient access to charging stations. The Electric Two Wheeler Charging Station Market is thus poised for growth, as manufacturers and service providers seek to meet the needs of a burgeoning customer base. The proliferation of electric two wheelers not only supports sustainability goals but also drives innovation in charging technologies, further enhancing the market's potential.

Urbanization and Changing Mobility Patterns

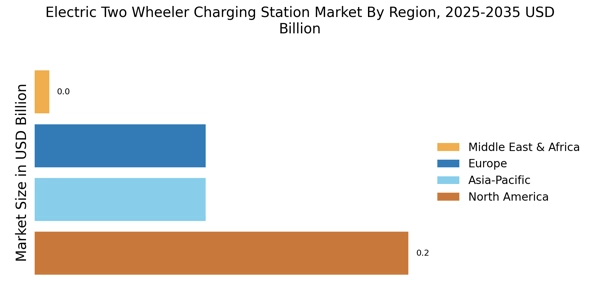

Urbanization and changing mobility patterns are significant factors influencing the Electric Two Wheeler Charging Station Market. As urban populations continue to grow, the demand for efficient and sustainable transportation solutions is becoming increasingly critical. Electric two wheelers offer a practical solution to urban congestion and pollution, making them an attractive option for city dwellers. In 2025, it is projected that urban areas will account for over 70% of electric two wheeler sales, driving the need for accessible charging stations. This trend indicates a shift in consumer preferences towards more sustainable modes of transport, thereby propelling the growth of the Electric Two Wheeler Charging Station Market. The integration of charging stations in urban planning is likely to become a priority for city authorities, further enhancing the market's prospects.

Increased Investment in Charging Infrastructure

Increased investment in charging infrastructure is a vital driver for the Electric Two Wheeler Charging Station Market. As the demand for electric two wheelers rises, stakeholders are recognizing the necessity of developing a robust charging network. In 2025, investments in charging infrastructure are expected to exceed 5 billion dollars, reflecting a growing commitment from both public and private sectors. This influx of capital is likely to facilitate the establishment of more charging stations, enhancing accessibility for electric two wheeler users. Furthermore, partnerships between governments and private companies are emerging to accelerate the deployment of charging solutions. This collaborative approach not only strengthens the Electric Two Wheeler Charging Station Market but also ensures that the infrastructure keeps pace with the rapid growth of electric vehicle adoption.

Technological Advancements in Charging Solutions

Technological advancements play a crucial role in shaping the Electric Two Wheeler Charging Station Market. Innovations such as fast charging solutions and wireless charging technologies are becoming increasingly prevalent. For instance, the development of ultra-fast charging stations can reduce charging times significantly, making electric two wheelers more appealing to consumers. In 2025, it is estimated that the market for fast charging solutions will grow by over 30%, driven by the need for efficient and user-friendly charging options. These advancements not only improve the user experience but also encourage the adoption of electric two wheelers, thereby stimulating the growth of the Electric Two Wheeler Charging Station Market. As technology continues to evolve, the integration of smart features, such as mobile app connectivity and real-time charging status updates, is likely to enhance the overall charging experience.