Increased Investment in Drone Infrastructure

Investment in drone infrastructure is a critical driver of the Germany drones market. The establishment of drone ports, charging stations, and maintenance facilities is essential for supporting the growing fleet of commercial drones. The German government, in collaboration with private enterprises, is actively investing in the development of this infrastructure to facilitate the safe and efficient operation of drones. Recent initiatives include the creation of designated air corridors for drone flights, which aim to minimize air traffic congestion and enhance safety. Furthermore, the European Union has proposed funding for drone infrastructure projects, which could further bolster the market. As a result, the infrastructure development is expected to create a conducive environment for the growth of the drone industry, potentially increasing operational efficiency and reducing costs for drone operators.

Technological Advancements in Drone Capabilities

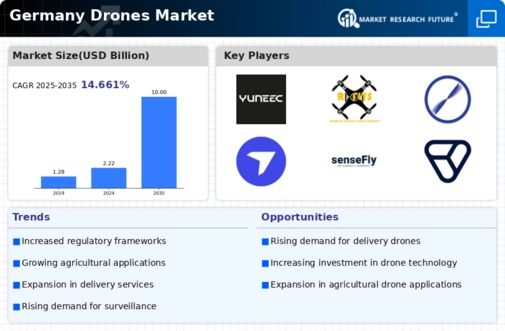

The Germany drones market is experiencing rapid technological advancements that enhance drone capabilities. Innovations in battery life, payload capacity, and autonomous navigation systems are driving the adoption of drones across various sectors. For instance, the integration of AI and machine learning in drone operations allows for improved data collection and analysis, which is particularly beneficial in agriculture and surveillance. According to recent data, the market for commercial drones in Germany is projected to grow significantly, with an estimated CAGR of 15% over the next five years. This growth is largely attributed to the increasing demand for high-performance drones that can operate in complex environments, thereby expanding their applications in industries such as construction, logistics, and emergency services.

Growing Demand for Aerial Surveillance and Security

The demand for aerial surveillance and security solutions is a prominent driver in the Germany drones market. With rising concerns over public safety and security, both governmental and private sectors are increasingly utilizing drones for monitoring and surveillance purposes. Drones equipped with high-resolution cameras and thermal imaging technology are being deployed for border control, traffic monitoring, and event security. The German government has recognized the potential of drones in enhancing national security and has allocated funding for research and development in this area. As a result, the market for security drones is expected to expand, with estimates suggesting a growth rate of approximately 12% annually. This trend indicates a shift towards more sophisticated surveillance methods, positioning drones as essential tools in modern security strategies.

Expansion of Drone Applications in Various Industries

The expansion of drone applications across various industries is significantly influencing the Germany drones market. Sectors such as agriculture, construction, and logistics are increasingly adopting drone technology for tasks ranging from crop monitoring to site inspections and delivery services. In agriculture, for example, drones are utilized for precision farming, enabling farmers to monitor crop health and optimize resource usage. The logistics sector is also witnessing a surge in drone deliveries, with companies exploring last-mile delivery solutions to enhance efficiency. According to industry reports, the agricultural drone market in Germany alone is expected to reach a valuation of over 500 million euros by 2027. This diversification of applications not only drives market growth but also encourages innovation and the development of specialized drones tailored to specific industry needs.

Supportive Regulatory Environment for Drone Operations

A supportive regulatory environment is a key driver of the Germany drones market. The German government has implemented regulations that facilitate the safe integration of drones into the airspace while ensuring public safety. The establishment of clear guidelines for commercial drone operations, including licensing requirements and operational restrictions, has encouraged businesses to invest in drone technology. Additionally, the European Union's regulatory framework for drones aims to standardize rules across member states, further promoting cross-border drone operations. As a result, the market is likely to see increased participation from various stakeholders, including startups and established companies. The regulatory clarity not only enhances safety but also fosters innovation, as companies are more willing to explore new applications and technologies within the established legal framework.