Germany Chemical Distribution Market Summary

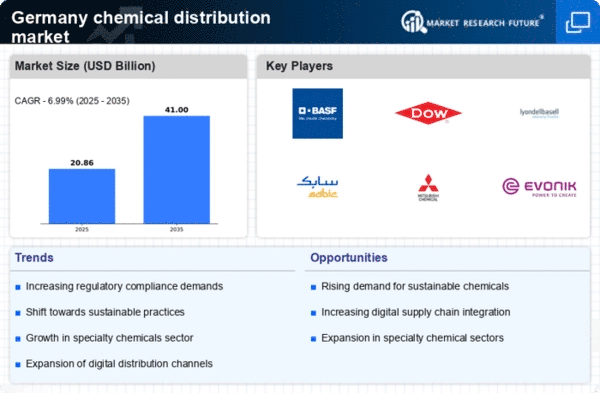

As per Market Research Future analysis, the Germany chemical distribution market size was estimated at 19.5 USD Billion in 2024. The Germany chemical distribution market is projected to grow from 20.86 USD Billion in 2025 to 41.0 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 6.9% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Germany chemical distribution market is experiencing a transformative shift towards sustainability and digitalization.

- Sustainability initiatives are becoming increasingly central to the strategies of chemical distributors in Germany.

- Digital transformation is reshaping operational efficiencies and customer engagement in the chemical distribution sector.

- The customization of offerings is gaining traction, particularly in the specialty chemicals segment, which is the largest in the market.

- Regulatory compliance pressure and sustainability-driven consumer preferences are key drivers influencing market dynamics.

Market Size & Forecast

| 2024 Market Size | 19.5 (USD Billion) |

| 2035 Market Size | 41.0 (USD Billion) |

| CAGR (2025 - 2035) | 6.99% |

Major Players

BASF (DE), Dow (US), LyondellBasell (US), SABIC (SA), Mitsubishi Chemical (JP), Evonik Industries (DE), Huntsman Corporation (US), Wacker Chemie (DE), Solvay (BE)