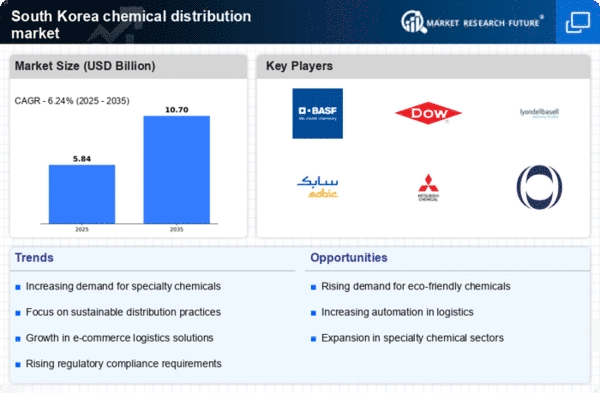

The chemical distribution market in South Korea is characterized by a dynamic competitive landscape, driven by innovation, sustainability, and strategic partnerships. Major players such as BASF (DE), Dow (US), and Mitsubishi Chemical (JP) are actively shaping the market through their operational strategies. BASF (DE) focuses on digital transformation and sustainability initiatives, aiming to enhance operational efficiency and reduce environmental impact. Dow (US) emphasizes regional expansion and innovation in product offerings, particularly in advanced materials. Meanwhile, Mitsubishi Chemical (JP) is investing in strategic partnerships to bolster its supply chain resilience and expand its market reach. Collectively, these strategies contribute to a competitive environment that is increasingly focused on sustainability and technological advancement.Key business tactics within the market include localizing manufacturing and optimizing supply chains to enhance responsiveness to customer needs. The competitive structure appears moderately fragmented, with several key players exerting influence over market dynamics. This fragmentation allows for a diverse range of products and services, catering to various industrial sectors. The collective actions of these major companies indicate a trend towards collaboration and innovation, which may reshape the competitive landscape in the coming years.

In October BASF (DE) announced a significant investment in a new digital platform aimed at streamlining its supply chain operations. This move is expected to enhance transparency and efficiency, allowing BASF (DE) to respond more effectively to market demands. The strategic importance of this investment lies in its potential to position BASF (DE) as a leader in digital supply chain management, thereby improving its competitive edge in the market.

In September Dow (US) launched a new line of sustainable chemical products designed to meet the growing demand for eco-friendly solutions. This initiative reflects Dow's commitment to sustainability and innovation, aligning with global trends towards greener practices. The introduction of these products is likely to strengthen Dow's market position and appeal to environmentally conscious consumers and businesses.

In August Mitsubishi Chemical (JP) entered into a strategic partnership with a local South Korean firm to enhance its distribution capabilities in the region. This collaboration aims to leverage local expertise and improve market penetration. The strategic significance of this partnership lies in its potential to accelerate Mitsubishi Chemical's growth in South Korea, allowing it to better serve its customers and adapt to local market conditions.

As of November current trends in the chemical distribution market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances are becoming more prevalent, as companies seek to enhance their competitive positioning through collaboration. Looking ahead, it appears that competitive differentiation will evolve from traditional price-based competition to a focus on innovation, technology, and supply chain reliability. This shift may redefine how companies engage with customers and compete in the marketplace.