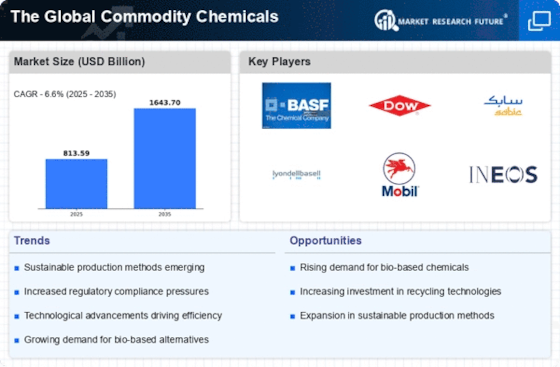

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the commodity chemicals market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the commodity chemicals industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global commodity chemicals industry to benefit clients and increase the market sector. In recent years, the commodity chemicals industry has offered some of the most significant advantages to medicine. Major players in the commodity chemicals market attempting to increase market demand by investing in research and development operations include BASF SE, Bayer Group, AkzoNobel N.V., The Dow Chemical Company, LyondellBasell Industries Holdings B.V., E.I. DuPont de Nemours and Company, Mitsui Chemicals, Braskem SA, PPG Industries, and Eastman Chemical Company.

A material science business, Dow Inc. is based. Through its fully owned subsidiary, The Dow Chemical Co (TDCC), the company conducts business. The product line of the company consists of silicones, industrial intermediates, silicone coatings, and plastics. The business caters to clients in the packaging, infrastructure, mobility, and consumer care sectors with a variety of goods and services. In addition to home and personal care, adhesives and sealants, durable goods, coatings, food, and specialty packaging, Dow's products are used in a variety of industries.

In August Dow Chemical Company reported investing in the US Gulf Coast's methyl acrylate industry.

The new 50 kiloton nameplate capacity of methyl acrylate, scheduled to go online in the first half of 2022, will be manufactured at St.Charles Operations in Louisiana, United States, and will enable worldwide growth with an emphasis on meeting North American demand.

BASF SE is a chemical business. It manufactures, markets, and sells chemicals, polymers, crop protection products, and performance items. The company's product line includes solvents, adhesives, surfactants, electronic chemicals, fuel additives, food additives, fungicides, pigments, paints, and herbicides. The company works with a wide range of industries, including those related to building, woodworking, agriculture, paints and coatings, transportation, home care, electronics and electrical, nutrition, and chemicals. In partnership with international customers, partners, and researchers, BASF carries out R&D.

In December 2020, select polyetheramine products will have new prices in the United States and Canada starting on January 1, 2021, or as long as current contracts allow. The amine products from BASF are utilised in a wide range of applications as highly effective curing agents, such as coatings and sealing compounds for the wind energy and electrical industries, as well as composites, adhesives, and floors.