Regulatory Compliance and Standards

The beverage packaging market in Germany is increasingly influenced by stringent regulatory compliance and standards. The German government has implemented various laws aimed at reducing environmental impact, such as the Packaging Act, which mandates recycling and waste reduction. This has led to a growing demand for eco-friendly packaging solutions. In 2023, approximately 70% of beverage packaging was reported to be recyclable, indicating a shift towards sustainable practices. Companies are now investing in materials that meet these regulations, which not only helps in compliance but also enhances brand reputation. As consumers become more environmentally conscious, adherence to these standards is likely to drive innovation in the beverage packaging market.

Rising Demand for Convenience Packaging

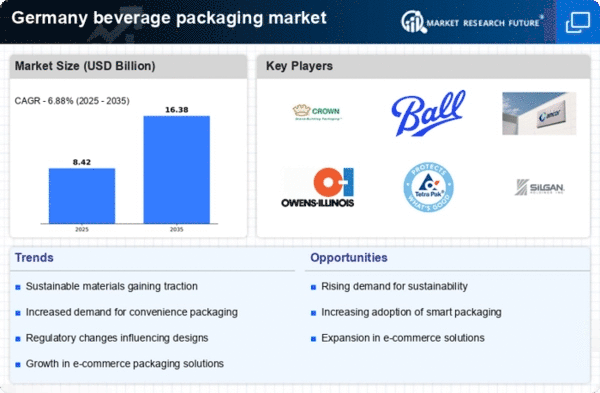

The beverage packaging market in Germany is experiencing a rising demand for convenience packaging solutions. As lifestyles become busier, consumers are increasingly seeking products that offer ease of use and portability. This trend is evident in the growing popularity of single-serve packaging and resealable options. In 2025, it is estimated that convenience packaging will account for 40% of the beverage packaging market. Manufacturers are responding by designing packaging that caters to on-the-go consumption, which is likely to enhance customer satisfaction and drive sales. This shift towards convenience is reshaping product offerings and packaging strategies across the industry.

Technological Advancements in Packaging

Technological advancements are playing a crucial role in transforming the beverage packaging market in Germany. Innovations such as smart packaging, which incorporates QR codes and NFC technology, are enhancing consumer engagement and providing valuable product information. Additionally, advancements in materials science are leading to the development of lighter and more durable packaging solutions. In 2024, it is projected that the market for smart packaging will grow by 15%, reflecting the increasing integration of technology in packaging design. These advancements not only improve functionality but also contribute to sustainability efforts, as companies seek to reduce material usage while maintaining product integrity.

Impact of E-commerce on Packaging Design

The growth of e-commerce is significantly impacting the beverage packaging market in Germany. As online shopping becomes more prevalent, there is a need for packaging that ensures product safety during transit while also being visually appealing. In 2025, it is projected that e-commerce sales in the beverage sector will increase by 25%, necessitating innovative packaging solutions that can withstand shipping challenges. Companies are focusing on designs that not only protect the product but also enhance the unboxing experience for consumers. This trend is likely to drive investment in packaging technologies that cater specifically to the demands of the e-commerce landscape.

Consumer Preference for Eco-Friendly Options

In Germany, there is a notable shift in consumer preferences towards eco-friendly packaging options within the beverage packaging market. Recent surveys indicate that over 60% of consumers are willing to pay a premium for products that utilize sustainable packaging. This trend is prompting manufacturers to explore biodegradable materials and recyclable designs. The increasing awareness of environmental issues is influencing purchasing decisions, leading to a rise in demand for beverages packaged in environmentally responsible materials. As a result, companies are adapting their strategies to align with consumer expectations, which is likely to shape the future landscape of the beverage packaging market.