E-commerce Growth

The rise of e-commerce is reshaping the Non Alcoholic Beverage Packaging Market. With more consumers opting for online shopping, packaging must adapt to ensure product safety during transit. This shift has led to an increased focus on durable and protective packaging solutions that can withstand the rigors of shipping. Additionally, brands are exploring innovative packaging designs that enhance the unboxing experience, which is crucial for customer satisfaction in the digital marketplace. Data suggests that e-commerce sales of non-alcoholic beverages are expected to grow at a rapid pace, further driving the need for effective packaging solutions. As a result, companies that invest in e-commerce-friendly packaging are likely to thrive in the evolving landscape of the Non Alcoholic Beverage Packaging Market.

Regulatory Compliance

Regulatory compliance is a critical driver in the Non Alcoholic Beverage Packaging Market. Governments worldwide are implementing stringent regulations regarding packaging materials and labeling requirements. This is particularly relevant in the context of food safety and environmental sustainability. Companies must navigate these regulations to avoid penalties and ensure consumer trust. The increasing emphasis on transparency in labeling is prompting brands to adopt clearer and more informative packaging designs. Furthermore, compliance with recycling and waste management regulations is becoming essential as consumers demand more sustainable practices. As a result, businesses that proactively address regulatory challenges are likely to enhance their reputation and competitiveness within the Non Alcoholic Beverage Packaging Market.

Health and Wellness Trends

Health and wellness trends are significantly impacting the Non Alcoholic Beverage Packaging Market. As consumers increasingly prioritize health-conscious choices, there is a growing demand for packaging that reflects these values. This includes packaging that highlights nutritional information and promotes portion control. The market for functional beverages, such as those enriched with vitamins and minerals, is expanding, necessitating packaging that preserves product integrity and freshness. Data indicates that health-oriented beverages are projected to account for a substantial share of the market, with consumers willing to pay a premium for products that align with their health goals. Consequently, packaging solutions that cater to these trends are becoming essential for brands aiming to succeed in the Non Alcoholic Beverage Packaging Market.

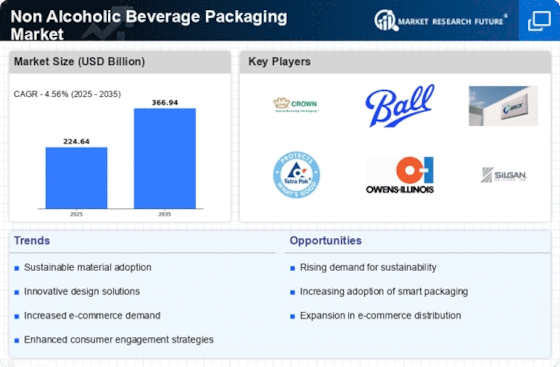

Sustainability Initiatives

The Non Alcoholic Beverage Packaging Market is increasingly influenced by sustainability initiatives. Consumers are becoming more environmentally conscious, prompting manufacturers to adopt eco-friendly packaging solutions. This shift is evident in the rising demand for biodegradable and recyclable materials. According to recent data, the market for sustainable packaging is projected to grow significantly, with a compound annual growth rate of over 10% in the coming years. Companies are investing in innovative materials that reduce carbon footprints and enhance recyclability. This trend not only meets consumer expectations but also aligns with regulatory pressures aimed at reducing plastic waste. As a result, businesses that prioritize sustainability in their packaging strategies are likely to gain a competitive edge in the Non Alcoholic Beverage Packaging Market.

Technological Advancements

Technological advancements play a pivotal role in shaping the Non Alcoholic Beverage Packaging Market. Innovations in packaging technology, such as smart packaging and automation, are enhancing efficiency and product safety. For instance, the integration of QR codes and NFC technology allows consumers to access product information and engage with brands more interactively. Furthermore, advancements in materials science are leading to the development of lighter and more durable packaging options, which can reduce shipping costs and environmental impact. The market is witnessing a surge in investments in research and development, with companies exploring new materials and designs that cater to evolving consumer preferences. This technological evolution is expected to drive growth and transformation within the Non Alcoholic Beverage Packaging Market.