Germany Battery Material Market Summary

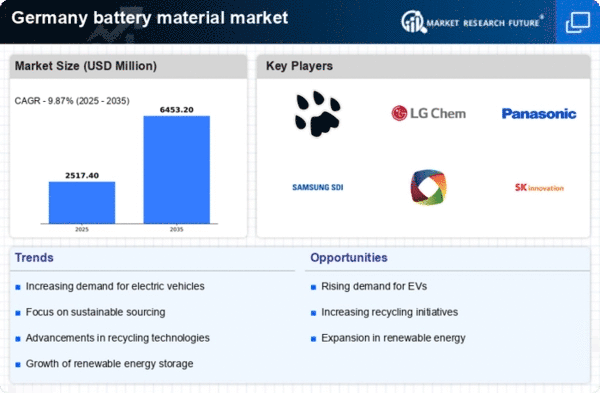

As per Market Research Future analysis, the Germany battery material market size was estimated at 2291.25 USD Million in 2024. The Germany battery material market is projected to grow from 2517.4 USD Million in 2025 to 6453.2 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 9.8% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Germany battery material market is poised for growth driven by sustainability and technological advancements.

- Sustainable material sourcing is becoming a pivotal trend in the Germany battery material market.

- Technological advancements in battery chemistry are enhancing performance and efficiency across various applications.

- The largest segment in this market is driven by the rising demand for electric vehicles, while the fastest-growing segment focuses on renewable energy storage solutions.

- Key market drivers include the increasing investment in renewable energy storage solutions and regulatory frameworks promoting sustainable practices.

Market Size & Forecast

| 2024 Market Size | 2291.25 (USD Million) |

| 2035 Market Size | 6453.2 (USD Million) |

| CAGR (2025 - 2035) | 9.87% |

Major Players

CATL (CN), LG Chem (KR), Panasonic (JP), Samsung SDI (KR), BYD (CN), SK Innovation (KR), AESC (JP), Tianjin Lishen Battery (CN), Northvolt (SE)