Investment in AI Startups

Investment in AI startups within the financial sector is witnessing a remarkable increase in Germany, which is likely to bolster the AI in Fintech Market. Venture capital firms and private equity investors are increasingly recognizing the potential of AI technologies to transform financial services. In 2025, investments in AI-driven fintech startups are projected to exceed €1 billion, reflecting a growing confidence in the market's future. This influx of capital is expected to accelerate innovation and the development of new AI applications, further propelling the growth of the ai in-fintech market.

Technological Advancements in AI

Technological advancements in AI are playing a pivotal role in shaping the AI in Fintech Market in Germany. Innovations in machine learning, natural language processing, and data analytics are enabling financial institutions to develop more sophisticated tools for customer engagement and risk assessment. The increasing availability of big data is also facilitating the training of AI models, which enhances their predictive capabilities. As a result, financial services are becoming more efficient and tailored to individual customer needs. This trend is expected to contribute to a projected market growth of approximately 30% by 2027, as institutions seek to harness these advancements for competitive advantage.

Regulatory Support for AI Adoption

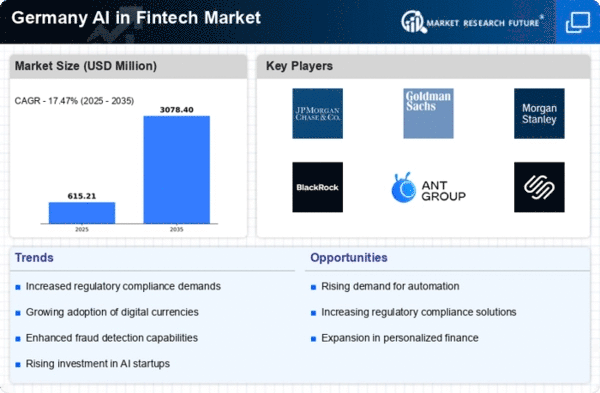

The regulatory landscape in Germany appears to be increasingly supportive of AI technologies, particularly in the financial sector. The German government has initiated various frameworks aimed at fostering innovation while ensuring consumer protection. This regulatory backing is likely to encourage financial institutions to adopt AI solutions, thereby enhancing operational efficiency and customer service. As of 2025, the AI in Fintech Market is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of around 25% over the next five years. This growth is largely attributed to the favorable regulatory environment that promotes the integration of AI technologies in financial services.

Consumer Preference for Digital Services

There is a noticeable shift in consumer preferences towards digital financial services in Germany, which is significantly impacting the AI in Fintech Market. As more consumers opt for online banking and mobile payment solutions, financial institutions are compelled to adopt AI technologies to meet these evolving demands. This shift is reflected in a survey indicating that over 60% of consumers prefer using digital channels for their banking needs. Consequently, the integration of AI-driven solutions is becoming essential for institutions aiming to enhance user experience and streamline operations, thereby driving growth in the ai in-fintech market.

Rising Demand for Fraud Detection Solutions

The surge in digital transactions in Germany has led to an increased demand for advanced fraud detection solutions within the AI in Fintech Market. Financial institutions are increasingly leveraging AI algorithms to analyze transaction patterns and identify anomalies in real-time. This trend is underscored by a report indicating that losses due to fraud in the financial sector could reach €5 billion annually by 2026 if not addressed effectively. Consequently, the integration of AI technologies is seen as a critical measure to mitigate risks and enhance security, thereby driving growth in the ai in-fintech market.