Enhanced Security Measures

The AI in Fintech Market is increasingly focused on enhanced security measures. With the rise of cyber threats and financial fraud, the need for robust security solutions has never been more critical. AI technologies can analyze transaction patterns in real-time, identifying anomalies that may indicate fraudulent activity. In 2025, it is estimated that AI-driven security solutions could reduce fraud losses by up to 40%. This capability not only protects financial institutions but also instills greater confidence among consumers. As the threat landscape evolves, the demand for AI solutions that can provide advanced security measures is likely to grow, making AI an indispensable tool in the fight against financial crime.

Data Analytics and Insights

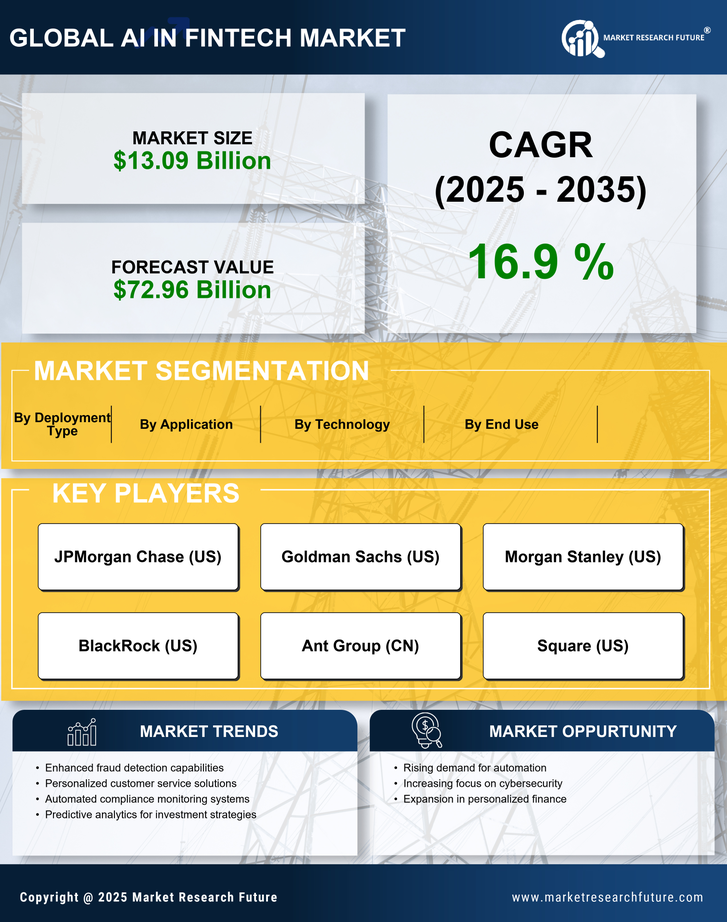

The AI in Fintech Market is significantly driven by the increasing importance of data analytics and insights. Financial institutions are inundated with vast amounts of data, and the ability to analyze this data effectively is paramount. AI technologies enable organizations to extract actionable insights from complex datasets, enhancing decision-making processes. In 2025, it is projected that the market for AI-driven analytics in finance could reach approximately 20 billion dollars. This growth is attributed to the rising demand for personalized financial services and improved customer targeting. By leveraging AI, financial institutions can better understand customer behavior, optimize product offerings, and enhance overall service delivery, thereby gaining a competitive edge in the market.

Cost Reduction and Efficiency

The AI in Fintech Market is propelled by the potential for cost reduction and operational efficiency. Financial institutions are continually seeking ways to minimize costs while maximizing productivity. AI technologies can automate routine tasks, such as data entry and transaction processing, which can lead to significant cost savings. In 2025, it is anticipated that AI implementation could reduce operational costs by up to 30% for some financial services firms. This efficiency not only allows for better allocation of resources but also enhances service delivery speed. As competition intensifies, the ability to operate efficiently through AI will likely become a key differentiator for financial institutions, driving further investment in AI technologies.

Regulatory Compliance and Governance

The AI in Fintech Market is increasingly influenced by the need for regulatory compliance and governance. Financial institutions are under constant scrutiny to adhere to stringent regulations, which necessitates the integration of AI technologies. These technologies can automate compliance processes, thereby reducing the risk of human error and ensuring adherence to evolving regulations. In 2025, it is estimated that compliance costs could account for up to 10% of total operational expenses for financial institutions. AI-driven solutions can streamline reporting and monitoring, making compliance more efficient. As regulatory frameworks continue to evolve, the demand for AI solutions that can adapt to these changes is likely to grow, positioning AI as a critical component in the governance strategies of financial organizations.

Personalization of Financial Services

The AI in Fintech Market is significantly influenced by the trend towards personalization of financial services. Consumers increasingly expect tailored financial products that meet their specific needs. AI technologies enable financial institutions to analyze customer data and preferences, allowing for the creation of personalized offerings. In 2025, it is projected that personalized financial services could account for over 25% of total financial product sales. This shift towards personalization not only enhances customer satisfaction but also fosters loyalty and retention. As financial institutions strive to differentiate themselves in a crowded market, the ability to leverage AI for personalized service delivery will likely become a critical success factor.