Aging Population

The aging population in the Americas serves as a significant driver for the Global Americas GERD and NERD Treatment Market Industry. As individuals age, the prevalence of GERD and NERD tends to increase due to physiological changes and comorbidities associated with older age. This demographic shift necessitates a greater focus on treatment options tailored to the needs of older adults. With the population aged 65 and older projected to reach 80 million by 2040, the demand for effective GERD and NERD treatments is expected to rise correspondingly, thereby propelling market growth.

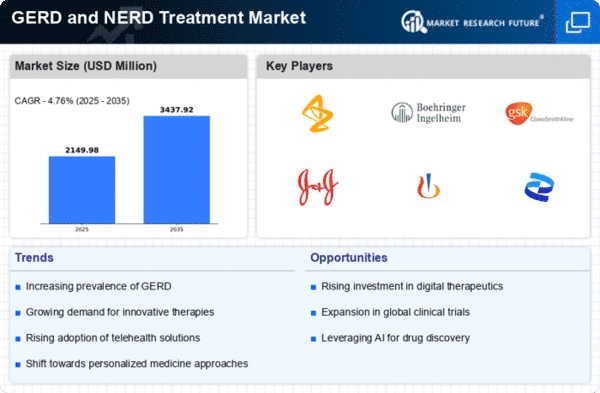

Market Growth Projections

The Global Americas GERD and NERD Treatment Market Industry is projected to experience substantial growth over the next decade. With an estimated market value of 2.16 USD Billion in 2024, it is expected to expand to 5.22 USD Billion by 2035, reflecting a CAGR of 8.36% from 2025 to 2035. This growth trajectory indicates a robust response to the increasing prevalence of GERD and NERD, advancements in treatment options, and heightened awareness among patients and healthcare providers. The market dynamics suggest a promising future for stakeholders involved in the development and distribution of GERD and NERD treatments.

Increased Awareness and Diagnosis

Growing awareness regarding GERD and NERD symptoms among the general population and healthcare providers is a crucial driver for the Global Americas GERD and NERD Treatment Market Industry. Enhanced educational initiatives and campaigns have led to improved diagnosis rates, allowing for timely intervention. As more individuals seek medical advice for reflux-related symptoms, the demand for diagnostic tools and treatment options is likely to rise. This trend is reflected in the projected compound annual growth rate (CAGR) of 8.36% from 2025 to 2035, indicating a robust market response to increased awareness and proactive healthcare measures.

Rising Prevalence of GERD and NERD

The increasing prevalence of gastroesophageal reflux disease (GERD) and non-erosive reflux disease (NERD) is a primary driver for the Global Americas GERD and NERD Treatment Market Industry. Recent estimates indicate that approximately 20% of the American population experiences GERD symptoms, contributing to a growing demand for effective treatment options. This trend is expected to continue, with the market projected to reach 2.16 USD Billion in 2024. The rising incidence of obesity and lifestyle factors, such as diet and stress, further exacerbate the condition, leading to a heightened focus on therapeutic interventions.

Advancements in Treatment Modalities

Innovations in treatment modalities significantly influence the Global Americas GERD and NERD Treatment Market Industry. The introduction of novel pharmacological agents, including proton pump inhibitors and H2 receptor antagonists, has transformed the management of GERD and NERD. Additionally, minimally invasive surgical techniques, such as fundoplication, have gained traction, offering patients effective alternatives to traditional surgery. As these advancements continue to evolve, they are likely to enhance patient outcomes and satisfaction, driving market growth. The anticipated expansion of the market to 5.22 USD Billion by 2035 underscores the importance of ongoing research and development in this field.

Lifestyle Changes and Dietary Habits

Shifts in lifestyle and dietary habits contribute to the rising incidence of GERD and NERD, thus impacting the Global Americas GERD and NERD Treatment Market Industry. The consumption of high-fat, spicy foods, and the prevalence of sedentary lifestyles have been linked to increased reflux symptoms. As awareness of these correlations grows, there is a potential for increased demand for therapeutic interventions. This trend may be further amplified by public health initiatives aimed at promoting healthier lifestyles, which could lead to a more proactive approach to managing GERD and NERD.