Increased Awareness and Advocacy

Heightened awareness and advocacy surrounding Autism Spectrum Disorder are pivotal in shaping the Autism Disorder and Treatment Market. Organizations and advocacy groups are actively promoting understanding and acceptance of ASD, which has led to increased public interest and demand for effective treatments. This growing awareness is reflected in the rising number of educational programs and community initiatives aimed at supporting individuals with autism. Furthermore, legislative efforts to improve access to care and funding for autism-related services are gaining momentum, which could potentially enhance the market landscape. As more individuals and families seek information and resources, the Autism Disorder and Treatment Market is likely to experience sustained growth.

Government Initiatives and Funding

Government initiatives and funding play a crucial role in the development of the Autism Disorder and Treatment Market. Various countries are implementing policies aimed at improving access to autism services and enhancing research funding. For instance, increased allocations for autism research and support programs are being observed, which could lead to the discovery of new treatment modalities. Additionally, public health campaigns aimed at raising awareness about ASD are likely to contribute to early diagnosis and intervention efforts. These government actions not only bolster the market but also create a supportive environment for innovation and collaboration among stakeholders in the Autism Disorder and Treatment Market.

Advancements in Therapeutic Technologies

Technological innovations are transforming the Autism Disorder and Treatment Market, offering new avenues for effective interventions. The integration of digital health solutions, such as teletherapy and mobile applications, has gained traction, providing accessible treatment options for families. Moreover, advancements in neurofeedback and virtual reality therapies are emerging as promising tools for managing ASD symptoms. The market for digital therapeutics is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 20% in the coming years. These technological advancements not only enhance the efficacy of treatments but also improve patient engagement, thereby driving the overall growth of the Autism Disorder and Treatment Market.

Diverse Treatment Options and Personalization

The Autism Disorder and Treatment Market is characterized by a diverse array of treatment options, which cater to the unique needs of individuals with ASD. From behavioral therapies to pharmacological interventions, the market offers a spectrum of choices that can be tailored to specific symptoms and challenges. The trend towards personalized treatment approaches is gaining traction, as practitioners increasingly recognize the importance of individualized care plans. This shift is supported by ongoing research into the efficacy of various interventions, which suggests that personalized strategies may yield better outcomes. As the demand for customized treatment solutions rises, the Autism Disorder and Treatment Market is poised for continued expansion.

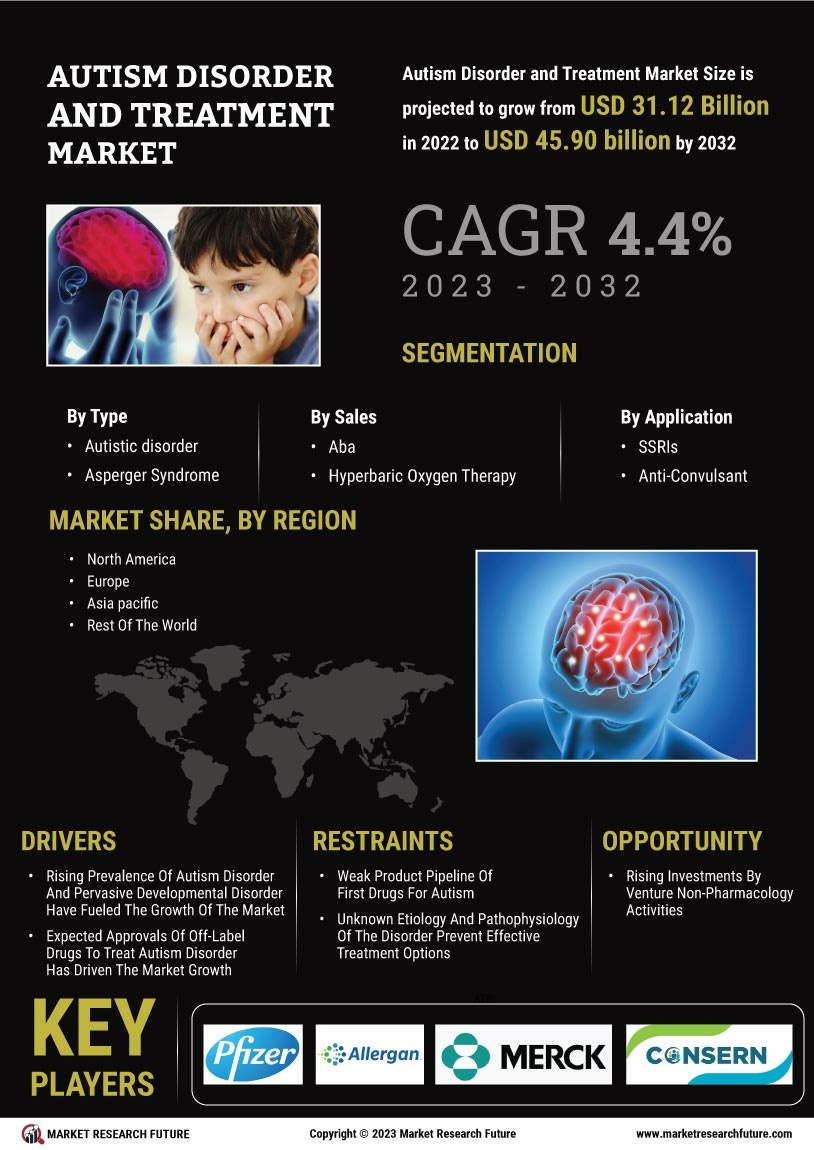

Increasing Prevalence of Autism Spectrum Disorder

The rising incidence of Autism Spectrum Disorder (ASD) is a primary driver of the Autism Disorder and Treatment Market. Recent estimates indicate that approximately 1 in 44 children are diagnosed with ASD, reflecting a notable increase in prevalence over the past decade. This surge necessitates enhanced treatment options and support services, thereby propelling market growth. As awareness of ASD expands, more families seek early intervention and tailored therapies, which further stimulates demand within the Autism Disorder and Treatment Market. The growing recognition of the importance of early diagnosis and intervention is likely to lead to increased funding for research and development of innovative treatment modalities, thereby fostering a more robust market landscape.