Market Analysis

In-depth Analysis of GERD and NERD Treatment Market Industry Landscape

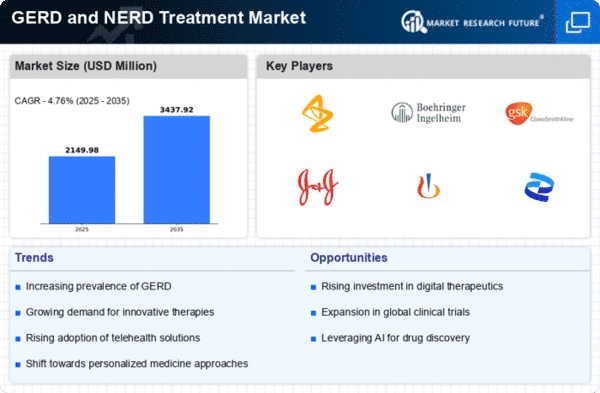

Gastroesophageal reflux disease (GERD) and non-erosive reflux sickness (NERD) are conventional gastrointestinal disorders characterized by way of the reflux of belly acid into the esophagus, leading to symptoms that include heartburn, regurgitation, and chest pain. The high prevalence of these situations, affecting thousands and thousands of individuals internationally, drives the demand for effective treatment options and impacts market dynamics considerably. Advances in diagnostic strategies, including top endoscopy, ambulatory pH monitoring, and esophageal manometry, have progressed the analysis and characterization of GERD and NERD Treatment. Accurate diagnosis is crucial for steering remedy selections and monitoring disease development, impacting market dynamics with the aid of influencing treatment choice and affected person results. The treatment panorama for GERD and NERD Treatment consists of lifestyle changes, pharmacological healing procedures, and surgical interventions aimed at lowering acid reflux disease, assuaging signs, and preventing headaches. Proton pump inhibitors (PPIs) are typically prescribed as first-line pharmacological remedies for GERD and NERD Treatment. However, a few patients may require alternative remedies, which include histamine receptor antagonists (H2RAs), antacids, or surgical interventions like fundoplication. The market for GERD and NERD treatment is characterized by extreme competition among pharmaceutical organizations, medical tool manufacturers, and healthcare carriers. Market dynamics are prompted by means of elements such as product innovation, pricing strategies, distribution channels, and strategic collaborations. Companies attempt to distinguish their products through advanced capabilities, improved efficacy, and patient-pleasant formulations to benefit a competitive side inside the market. Patient preferences, such as treatment adherence and first-class of existence effects, affect the adoption of particular treatment modalities in the GERD and NERD Treatment market. Improvements in symptom management, symptom remedy, and long-term quality of lifestyles are key considerations for patients while deciding on remedy options. Patient-targeted care and shared selection-making contribute to market dynamics by shaping remedy picks and healthcare delivery trends. Regional versions in healthcare infrastructure, cultural attitudes toward GERD and NERD Treatment, and the right of entry to specialized care impact market dynamics. Ongoing technological innovations in GERD and NERD Treatment remedies, which include minimally invasive endoscopic tactics, wi-fi pH monitoring devices, and impedance checking out, make contributions to the evolving market dynamics. These improvements improve diagnostic accuracy, treatment efficacy, and patient effects, addressing unmet needs and riding the demand for innovative answers in reflux management. Investment in studies and development efforts for GERD and NERD Treatment remedies is driven by elements that include market demand, technological advancements, and regulatory incentives. Funding from authorities, businesses, personal buyers, and philanthropic corporations supports innovation inside the GERD and NERD Treatment market and impacts market dynamics. The GERD and NERD Treatment remedy market is anticipated to witness a persistent increase and innovation pushed via improvements in technology, growing demand for patient-centered care, and a growing emphasis on personalized remedies in healthcare. Collaboration between stakeholders, funding in studies and development efforts, and coverage initiatives geared toward enhancing admission to specialized care will play an essential position in shaping the destiny dynamics of the GERD and NERD Treatment market.

Leave a Comment