Research Methodology on Geographic Atrophy (GA) Market

Introduction

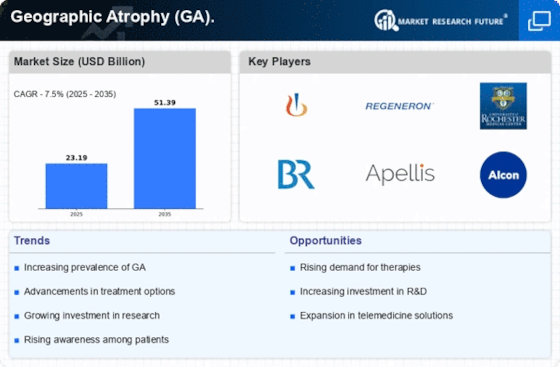

Geographic Atrophy (GA) is a rare eye condition characterized by the degeneration of the retinal pigment epithelium (RPE). The condition leads to progressive vision loss in affected individuals. It is estimated that GA affected approximately 50,000 individuals in 2014 and the overall prevalence of GA is expected to increase over the next few years. The increasing prevalence of GA is expected to propel the growth of the global Geographic Atrophy (GA) Market during the forecast period 2023–2030.

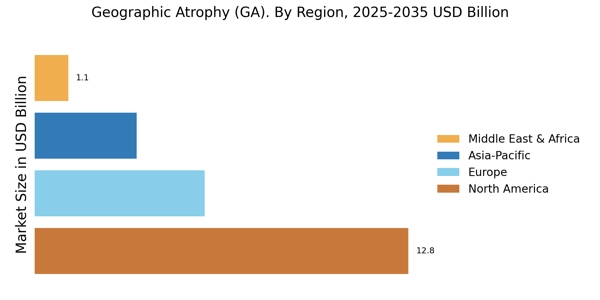

The goal of this research is to examine the global Geographic Atrophy (GA) market and analyze the trends, drivers, and opportunities. The scope of the report includes a detailed study of the Geographic Atrophy (GA) market with the current market scenario, key trends, and emerging technology trends and challenges. The market is further segmented by regions, through a detailed analysis of the market drivers, challenges and trends in the region. The market size of the market during the forecast period 2023–2030 is examined in terms of value (USD million).

Research Methodology

A comprehensive research methodology is a necessary tool that meets the objectives of a research project. Research methodology provides detailed plans and procedures which are used in data collection and data analysis. A suitable methodology is essential for achieving reliable and unbiased results. The research methodology used for this study includes four main stages: Exploratory Research, Descriptive Research, Experimental Research, and Conclusion.

Exploratory Research

The purpose of the exploratory research is to gain an in-depth understanding of the Global Geographic Atrophy (GA) market as well as to identify the opportunities and constraints existing in the market. Several factors such as market size, segmentation, drivers, challenges, and trends are taken into consideration. Various secondary sources such as market reports, industry journals, and statistical databases have been used to identify and evaluate the current market scenario.

Descriptive Research

Descriptive research is undertaken to collect detailed and verified information regarding the Global Geographic Atrophy (GA) market. For this purpose, several primary and secondary research methods have been employed, such as SWOT analysis, market survey, competitive landscape and industry trends. Primary research methods include interviews with key executives and industry experts. In addition, to get information related to the regional market, five focus group discussions are conducted in the US, UK, and Germany.

Experimental Research

Experimental research is conducted to find the correlation between key variables and to identify the impact of the independent variable on the dependent variable. The experiments are conducted on several aspects of the market such as regional market share, market size, regional growth rate, and pricing strategies. In addition, a questionnaire survey is also conducted with key players and industry experts to identify and analyze their opinion regarding the Global Geographic Atrophy (GA) market.

Conclusion

The research methodology used in this study provides a comprehensive view of the Global Geographic Atrophy (GA) market. The results of the research are used to gain insights into market dynamics, trends, and opportunities. The obtained results can also be used to develop strategies to further strengthen the market position.