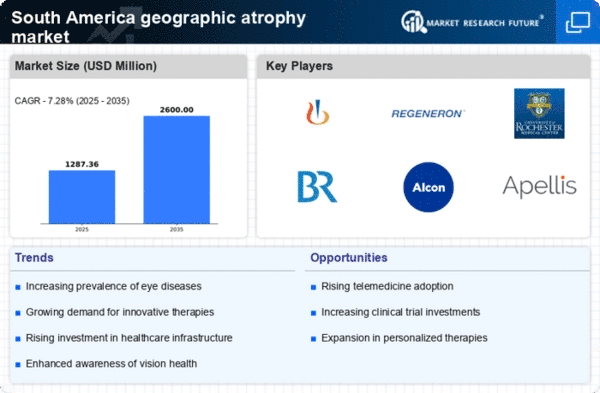

Increasing Aging Population

The demographic shift towards an older population in South America is a crucial driver for the geographic atrophy-ga market. As individuals age, the risk of developing age-related eye diseases, including geographic atrophy, escalates. Current estimates suggest that by 2030, approximately 20% of the South American population will be over 60 years old. This growing segment is likely to increase the demand for diagnostic and therapeutic options in the geographic atrophy-ga market. Furthermore, healthcare systems may need to adapt to accommodate the rising prevalence of this condition, potentially leading to increased funding and resources allocated to eye health initiatives. The aging population's impact on healthcare infrastructure could also stimulate innovation in treatment modalities, thereby enhancing the overall market landscape.

Rising Healthcare Expenditure

Healthcare expenditure in South America has been on an upward trajectory, which appears to positively influence the geographic atrophy-ga market. Increased spending on healthcare services, projected to reach $1 trillion by 2025, allows for better access to advanced diagnostic tools and treatment options for geographic atrophy. This financial commitment from both public and private sectors may facilitate the introduction of innovative therapies and technologies, thereby improving patient outcomes. Additionally, as healthcare budgets expand, there is a potential for increased awareness and education regarding geographic atrophy, leading to earlier diagnosis and intervention. This trend could ultimately drive market growth as more patients seek treatment for this debilitating condition.

Technological Advancements in Diagnostics

Technological innovations in diagnostic tools are significantly shaping the geographic atrophy-ga market in South America. Enhanced imaging techniques, such as optical coherence tomography (OCT), are becoming more widely available, allowing for earlier and more accurate detection of geographic atrophy. The adoption of these advanced technologies is likely to improve patient management and treatment outcomes. As healthcare providers increasingly utilize these tools, the demand for related services and products is expected to rise. Furthermore, the integration of artificial intelligence in diagnostic processes may streamline workflows and enhance the precision of diagnoses, potentially leading to a more robust geographic atrophy-ga market. This trend indicates a shift towards more proactive healthcare approaches in managing eye diseases.

Growing Awareness and Education Initiatives

Awareness campaigns and educational initiatives regarding geographic atrophy are gaining momentum in South America. Organizations and healthcare providers are increasingly focusing on informing the public about the risks and symptoms associated with this condition. Such efforts are likely to lead to higher rates of early diagnosis and treatment, which could positively impact the geographic atrophy-ga market. Increased awareness may also encourage individuals to seek regular eye examinations, further driving demand for diagnostic services. As more patients become informed about their options, the market may experience growth in both preventive measures and therapeutic interventions. This trend underscores the importance of education in enhancing patient outcomes and fostering a more informed patient population.

Regulatory Support for Innovative Therapies

Regulatory bodies in South America are increasingly supportive of innovative therapies for geographic atrophy, which may significantly influence the market landscape. Streamlined approval processes for new treatments can facilitate quicker access to cutting-edge therapies for patients. This regulatory environment appears to encourage pharmaceutical companies to invest in research and development, potentially leading to a wider array of treatment options. As new therapies enter the market, competition may intensify, driving down costs and improving accessibility for patients. The proactive stance of regulatory agencies in promoting innovation could thus play a pivotal role in shaping the future of the geographic atrophy-ga market, ensuring that patients have access to the latest advancements in care.