Aging Population Dynamics

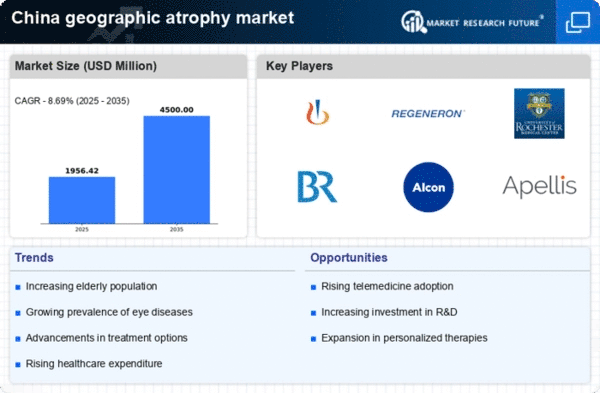

The demographic shift towards an older population in China appears to be a primary driver for the geographic atrophy-ga market. As the population aged 65 and above is projected to reach approximately 300 million by 2035, the incidence of age-related macular degeneration (AMD) is likely to increase. This demographic trend suggests a growing need for effective treatments and management strategies for geographic atrophy. The geographic atrophy-ga market may experience heightened demand for therapies that address the specific needs of this aging cohort, potentially leading to increased investments in research and development. Furthermore, the rising awareness of eye health among older adults could contribute to earlier diagnosis and treatment, thereby expanding the market further.

Rising Awareness and Education

The increasing awareness and education regarding eye health in China are likely to drive the geographic atrophy-ga market. Public health campaigns and educational programs aimed at informing the population about the risks and symptoms of AMD are becoming more prevalent. This heightened awareness may lead to earlier diagnosis and treatment of geographic atrophy, which could positively influence market growth. The geographic atrophy-ga market may benefit from collaborations between healthcare providers and educational institutions to promote eye health. As more individuals become informed about the importance of regular eye examinations, the demand for treatments is expected to rise, further propelling the market.

Government Initiatives and Funding

Government initiatives aimed at improving healthcare access and funding for eye diseases are likely to bolster the geographic atrophy-ga market in China. The Chinese government has been increasing its healthcare budget, with a focus on chronic diseases, including AMD. In 2025, the healthcare expenditure is expected to reach around 7 trillion CNY, which may facilitate the development and distribution of innovative treatments for geographic atrophy. Additionally, public health campaigns aimed at educating the population about eye health could lead to earlier detection and treatment of geographic atrophy, thereby driving market growth. The geographic atrophy-ga market may benefit from these initiatives, as they could enhance patient access to necessary therapies.

Investment in Research and Development

Investment in research and development (R&D) for geographic atrophy treatments is a crucial driver for the market in China. Pharmaceutical companies and biotech firms are increasingly allocating resources towards the discovery of novel therapies for AMD and its associated conditions. In 2025, R&D spending in the healthcare sector is projected to exceed 1 trillion CNY, indicating a robust commitment to advancing treatment options. The geographic atrophy-ga market may experience growth as new therapies emerge from this investment, potentially leading to improved patient outcomes. Additionally, partnerships between academic institutions and industry players could foster innovation, further enhancing the market landscape.

Technological Advancements in Treatment

Technological advancements in treatment modalities for geographic atrophy are anticipated to significantly impact the market. Innovations such as gene therapy and advanced drug delivery systems are emerging, potentially offering new avenues for managing this condition. The geographic atrophy-ga market may see a surge in research focused on these cutting-edge technologies, which could lead to more effective and targeted therapies. As these technologies become more accessible, they may improve patient outcomes and increase the overall market size. Furthermore, the integration of artificial intelligence in treatment planning and monitoring could enhance the efficiency of care delivery, thereby attracting more investment into the geographic atrophy-ga market.