Genset Market Summary

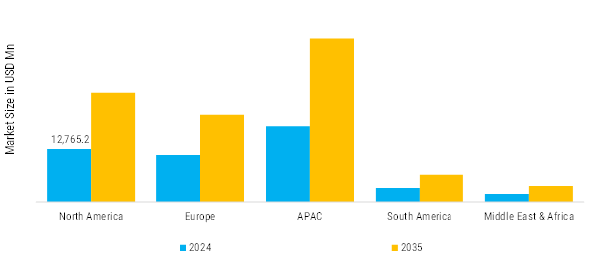

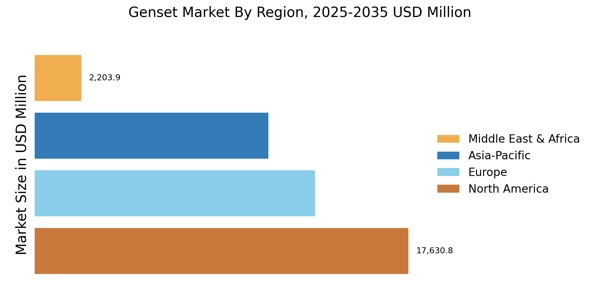

As per Market Research Future analysis, the Global Genset Market Size was estimated at 47872.14 USD Million in 2024. The Genset industry is projected to grow from 50848.88 USD Million in 2025 to 97650.99 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 6% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Genset Market is experiencing robust growth driven by the increasing need for reliable and uninterrupted power supply across commercial, industrial, and residential sectors.

- The market is witnessing increasing demand for continuous and reliable power supply across residential, commercial, and industrial sectors.

- Growing demand for reliable and continuous power across industrial, commercial, and residential sectors, high operational costs remain a significant market restraint.

- Growing adoption of fuel cell generators, driven by increasing environmental awareness, stringent emission regulations, and the rising demand for reliable and continuous power.

- Rapid advancements in artificial intelligence (AI), machine learning, and cloud computing, has substantially increased the global demand for reliable and continuous power supply, thereby accelerating the growth of the global genset market.

Market Size & Forecast

| 2024 Market Size | 47872.14(USD Million) |

| 2035 Market Size | 97650.99 (USD Million) |

| CAGR (2025 - 2035) | 6.7 % |

Major Players

Caterpillar, Cummins Inc, Generac Power Systems, Inc, Discovery Energy, LLC, Rolls-Royce plc, Doosan Group, Atlas Copco, HIMOINSA, Briggs & Stratton, AKSA POWER GENERATION