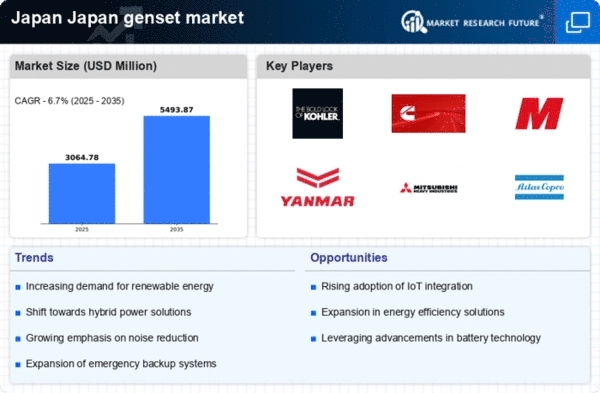

Growing Industrialization

The Japan Genset Market is experiencing a notable surge due to the rapid industrialization across various sectors. As industries expand, the demand for reliable power sources becomes paramount. In 2025, the industrial sector accounted for approximately 30% of the total genset consumption in Japan, indicating a robust reliance on these power solutions. This trend is likely to continue as manufacturers seek to enhance operational efficiency and minimize downtime. Furthermore, the Japanese government has been promoting initiatives to modernize industrial facilities, which may further drive the adoption of advanced genset technologies. The integration of gensets in manufacturing processes not only ensures uninterrupted power supply but also supports the country's economic growth, making it a critical driver in the Japan Genset Market.

Technological Advancements

The Japan Genset Market is witnessing a wave of technological advancements that enhance the efficiency and performance of gensets. Innovations such as IoT integration, remote monitoring, and automated control systems are becoming increasingly prevalent. In 2025, it was reported that smart gensets accounted for nearly 35% of the total market share, reflecting a growing preference for advanced power solutions. These technologies not only improve operational efficiency but also facilitate predictive maintenance, reducing downtime and operational costs. As businesses in Japan continue to seek ways to optimize their energy consumption, the demand for technologically advanced gensets is expected to rise. This trend indicates a shift towards more intelligent power solutions, positioning the Japan Genset Market for sustained growth.

Rising Demand in Data Centers

The proliferation of data centers in Japan is emerging as a significant driver for the Japan Genset Market. With the increasing reliance on digital infrastructure, the need for uninterrupted power supply in data centers has become critical. In 2025, it was estimated that the data center sector contributed approximately 20% to the overall genset demand, highlighting the importance of reliable power solutions in this domain. As data centers expand to accommodate growing data storage and processing needs, the demand for high-capacity gensets is likely to increase. This trend not only underscores the importance of gensets in supporting technological advancements but also positions the Japan Genset Market as a key player in the evolving digital landscape.

Government Regulations and Incentives

The Japan Genset Market is significantly influenced by government regulations aimed at promoting energy efficiency and reducing carbon emissions. The Japanese government has implemented stringent policies that encourage the use of cleaner energy sources, which may lead to an increased demand for hybrid and renewable gensets. In 2025, it was reported that approximately 40% of new genset installations were compliant with these regulations, reflecting a shift towards sustainable energy solutions. Additionally, financial incentives for businesses adopting eco-friendly technologies could further stimulate market growth. These regulations not only foster innovation within the genset sector but also align with Japan's commitment to achieving its climate goals, thereby serving as a crucial driver for the Japan Genset Market.

Natural Disasters and Emergency Preparedness

Japan's geographical location makes it susceptible to natural disasters such as earthquakes and typhoons, which significantly impacts the Japan Genset Market. The need for reliable backup power solutions has become increasingly critical for both residential and commercial sectors. In 2025, it was estimated that the demand for gensets in emergency preparedness applications rose by 25%, as businesses and households sought to ensure continuity during power outages. This heightened awareness of the importance of emergency power solutions is likely to drive further investments in genset technologies. As a result, manufacturers are focusing on developing robust and efficient gensets that can withstand extreme conditions, thereby reinforcing the market's resilience and adaptability in the face of natural calamities.