Rising Incidence of Cancer

The increasing incidence of cancer worldwide is a primary driver for the Genomics In Cancer Care Market. According to recent statistics, cancer cases are projected to rise significantly, with estimates suggesting that by 2040, there could be over 27 million new cancer cases annually. This alarming trend necessitates innovative approaches to cancer treatment, where genomics plays a crucial role. The ability to tailor therapies based on individual genetic profiles enhances treatment efficacy and minimizes adverse effects. As healthcare systems grapple with the growing burden of cancer, the demand for genomic solutions is likely to surge, propelling the Genomics In Cancer Care Market forward.

Supportive Regulatory Environment

A supportive regulatory environment is instrumental in fostering the growth of the Genomics In Cancer Care Market. Regulatory agencies are increasingly recognizing the importance of genomic data in clinical decision-making, leading to streamlined approval processes for genomic tests and therapies. Initiatives aimed at expediting the review of innovative cancer treatments are becoming more common, with agencies like the FDA implementing programs to facilitate the development of breakthrough therapies. This regulatory support not only encourages investment in genomic research but also enhances market confidence, thereby driving the expansion of the Genomics In Cancer Care Market.

Advancements in Genomic Technologies

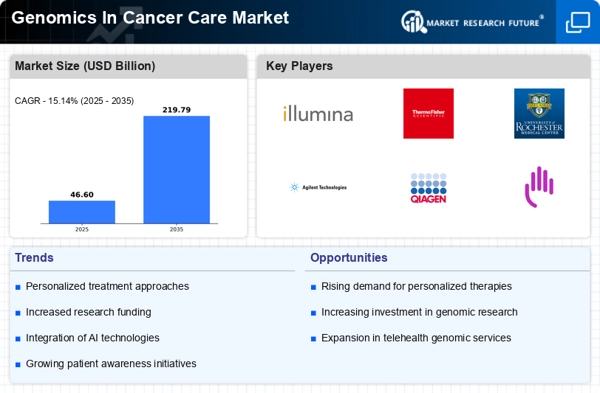

Technological advancements in genomic sequencing and analysis are transforming the landscape of cancer care, serving as a vital driver for the Genomics In Cancer Care Market. Innovations such as next-generation sequencing (NGS) have significantly reduced the cost and time required for genomic analysis, making it more accessible to healthcare providers. The market for NGS is expected to reach approximately USD 10 billion by 2026, reflecting the growing reliance on genomic data for personalized treatment plans. These advancements not only enhance the precision of cancer diagnostics but also facilitate the discovery of novel therapeutic targets, thereby driving the expansion of the Genomics In Cancer Care Market.

Growing Awareness of Precision Medicine

The rising awareness and acceptance of precision medicine among healthcare professionals and patients are pivotal drivers for the Genomics In Cancer Care Market. As patients become more informed about their treatment options, there is a growing demand for personalized therapies that consider individual genetic makeup. Surveys indicate that over 70% of oncologists believe that genomic testing is essential for effective cancer treatment. This shift towards precision medicine not only enhances treatment outcomes but also aligns with the broader trend of patient-centered care. Consequently, the Genomics In Cancer Care Market is likely to experience accelerated growth as more stakeholders recognize the value of genomic insights in cancer management.

Increased Investment in Research and Development

Investment in research and development (R&D) within the field of genomics is a critical driver for the Genomics In Cancer Care Market. Pharmaceutical companies and biotech firms are increasingly allocating resources to explore genomic-based therapies, with R&D spending in oncology expected to exceed USD 200 billion by 2025. This influx of funding fosters innovation, leading to the development of new genomic tests and treatments that can improve patient outcomes. As the understanding of cancer genomics deepens, the potential for breakthroughs in targeted therapies and immunotherapies becomes more pronounced, further stimulating growth in the Genomics In Cancer Care Market.