Top Industry Leaders in the Gelatin Market

On Nov.06, 2023, Scientists announced the development of tissue adhesive gelatin hydrogels to speed up wound healing and prevent infections. Tissue adhesive patches offer an innovative solution, allowing precise adhesion control and mechanical properties through adjustable polymeric compositions. These patches can also deliver drugs directly to wounds, enhancing recovery.

On Sep. 25, 2023, Strides Pharma announced its plan to spin off its CDMO (Contract Development and Manufacturing Organization) and soft gelatin businesses into OneSource. Expected to be completed by Apr. 1, 2024, the demerger will position OneSource as India's first specialty pharma pure play CDMO. The identified CDMO business of Steriscience and the soft gelatin business under Stelis will be called OneSource.

On May 30, 2023, Turkish leather producer Iskefe Holding announced its plan to build a $40 MN gelatin leather production factory in Egypt. The company is also considering developing and operating three production units at Roubiki Leather City. The company's targeted projects in Egypt will likely fulfill the needs of the market and export production in the country and abroad.

On Apr.03, 2023, Researchers at the Terasaki Institute for Biomedical Innovation in Los Angeles announced the development of a gelatin-based surgical sealant. The thermoresponsive sealant can rapidly form a semi-solid bolus when it reaches body temperature. It is also a bioadhesive that can adhere to slippery, wet surfaces in the body with relative ease.

On Mar. 23, 2023, GELITA launched a fast-setting gelatine, CONFIXX, that enables a breakthrough in fortified gummy production. The new gelatine, CONFIXX, allows starch-free production of gummies with a sensorial profile. This invention will open up opportunities for supplement manufacturers to work with different active ingredients and simplify the production process while making considerable cost savings.

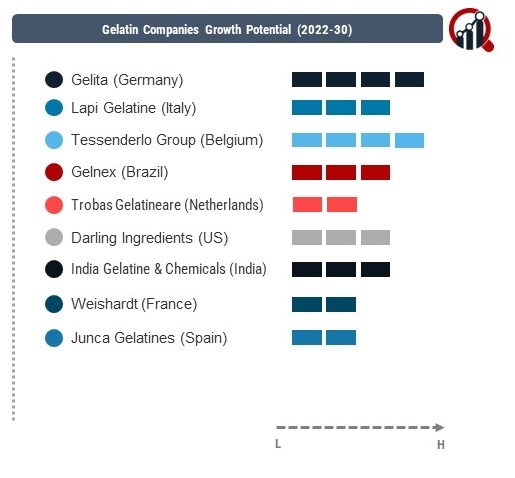

Key Companies in the gelatin market includes

- Gelita (Germany)

- Lapi Gelatine (Italy)

- Tessenderlo Group (Belgium)

- Gelnex (Brazil)

- Trobas Gelatineare (Netherlands)

- Darling Ingredients (US)

- India Gelatine & Chemicals (India)

- Weishardt (France)

- Junca Gelatines (Spain)

- Nitta Gelatin (India)

- Italgelatine (Italy) among others

- Beta

Beta feature

- Beta

Beta feature