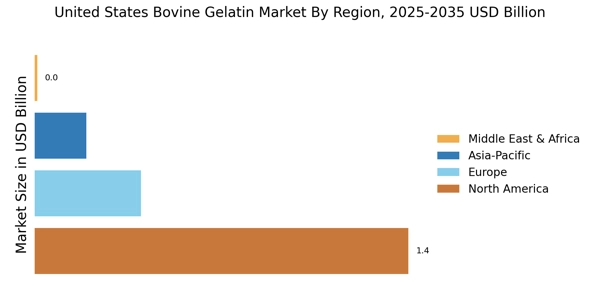

North America : Market Leader in Gelatin

The North American bovine gelatin market is primarily driven by the increasing demand for food and pharmaceutical applications. The U.S. holds the largest market share at approximately 70%, followed by Canada at around 20%. Regulatory support from agencies like the FDA ensures product safety and quality, further boosting market growth. The rising trend of clean-label products is also a significant catalyst for demand in this region.

The competitive landscape is characterized by key players such as PB Gelatins and Gelita AG, which dominate the market with their extensive product portfolios. The presence of advanced manufacturing facilities and strong distribution networks enhances their market position. Additionally, the growing trend of health-conscious consumers is pushing companies to innovate and offer gelatin products that meet specific dietary needs, thereby expanding their customer base.

Europe : Regulatory Framework and Growth

Europe's bovine gelatin market is characterized by stringent regulations and a growing demand for high-quality food products. The region is the second-largest market, with Germany and France leading the charge, holding approximately 25% and 20% market shares, respectively. The European Food Safety Authority (EFSA) plays a crucial role in ensuring product safety, which is a significant driver for market growth. The increasing popularity of gelatin in the pharmaceutical and cosmetic industries also contributes to the rising demand.

Leading countries in this region include Germany, France, and the Netherlands, with a competitive landscape featuring major players like Rousselot and Gelita AG. The presence of these companies, along with a focus on sustainable sourcing and innovation, positions Europe as a key player in The United States Bovine Gelatin. The region's emphasis on quality and safety standards further enhances its market appeal, attracting both consumers and manufacturers alike.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region is witnessing rapid growth in the bovine gelatin market, driven by increasing consumer awareness and demand for gelatin-based products in food and pharmaceuticals. Countries like China and India are leading this growth, with China holding approximately 30% of the market share, followed by India at around 15%. The region's expanding middle class and rising disposable incomes are significant factors contributing to this trend, alongside supportive government policies promoting food safety and quality.

The competitive landscape in Asia-Pacific is evolving, with both local and international players vying for market share. Key companies such as Nitta Gelatin and Gelnex are expanding their operations to meet the growing demand. The focus on innovation and product development, particularly in health and wellness segments, is driving competition. As the region continues to develop, the demand for high-quality gelatin products is expected to rise, further solidifying its position in the global market.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa region presents untapped opportunities in the bovine gelatin market, driven by increasing demand in food, pharmaceuticals, and cosmetics. The market is still developing, with countries like South Africa and the UAE leading the way, holding approximately 20% and 15% market shares, respectively. The region's growing population and rising health consciousness are key drivers for market growth, alongside regulatory frameworks that are gradually becoming more supportive of food safety standards.

The competitive landscape is characterized by a mix of local and international players, with companies like Weishardt Group and Jungbunzlauer making significant inroads. The focus on product innovation and meeting specific consumer needs is crucial for capturing market share. As the region continues to evolve, the demand for high-quality gelatin products is expected to increase, providing ample opportunities for growth and expansion.