GCC Oil & Gas Projects Market

GCC Oil and Gas Projects Market GCC Oil and Gas Projects Market Research Report: By Type (Surface and Lease Equipment, Gathering & Processing, Oil, Gas & NGL Pipelines, Oil & Gas Storage, Refining & Oil Products Transport and Export Terminals) andBy Drilling (Offshore, Onshore)- Forecast to 2035

GCC Oil and Gas Projects Market Overview:

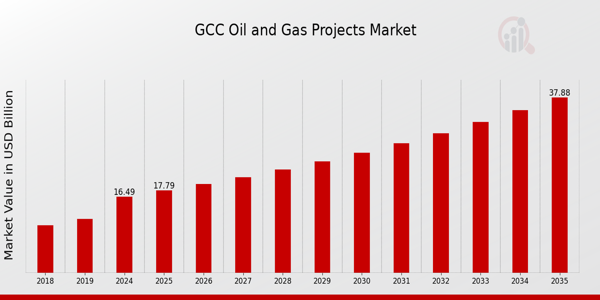

As per MRFR analysis, the GCC Oil and Gas Projects Market Size was estimated at 15.61 (USD Billion) in 2023.The GCC Oil and Gas Projects Market is expected to grow from 16.49(USD Billion) in 2024 to 37.88 (USD Billion) by 2035. The GCC Oil and Gas Projects Market CAGR (growth rate) is expected to be around 7.854% during the forecast period (2025 - 2035).

Key GCC Oil and Gas Projects Market Trends Highlighted

Numerous variables are driving notable trends in the GCC Oil and Gas Projects Market. As the area continues to experience significant economic expansion and urbanization, one major market driver is the rising demand for energy.

In order to increase sustainability and operational efficiency, investments in oil and gas are also being pushed by the push for economic diversification, which is highlighted in programs like Saudi Vision 2030 and the UAE's Economic Vision 2021.

Technological developments in production and extraction methods are also changing project plans, increasing output while cutting expenses. The GCC countries' dedication to a more balanced energy portfolio is seen in the recent discernible trend towards the use of renewable energy and its integration with conventional oil and gas operations.

Additionally, the sector is fully embracing the use of digital technologies like AI and IoT to enhance decision-making and boost safety protocols. The creation of services and infrastructure to support these initiatives presents emerging prospects, especially in sectors like petrochemical manufacturing and offshore drilling.

Another chance is the cooperation between GCC nations and foreign companies, which promotes innovation in project execution and information transfer. As GCC countries concentrate on cleaner production techniques and carbon management plans, partnerships are crucial to tackling the problems posed by climate change.

The GCC Oil and Gas Projects Market is positioned for future growth and resilience in a shifting global energy market thanks to these tendencies, which point to a transitional phase when old methods coexist with contemporary techniques.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

GCC Oil and Gas Projects Market Drivers

Increasing Global Energy Demand

The GCC Oil and Gas Projects Market is primarily driven by the increasing global energy demand. The International Energy Agency projected that oil and natural gas will continue to be the dominant sources of energy globally as populations rise and economies grow, particularly in emerging markets.

With countries like Saudi Arabia and the UAE having substantial oil reserves, these nations are positioned to meet this escalating demand. According to the U.S. Energy Information Administration, global oil consumption is projected to reach around 113 million barrels per day by 2040.

This upward trend fuels investments in exploration and production projects, technology advancements, and infrastructural growth in the GCC region. Firms like Saudi Aramco continue to expand their operations, exemplifying the extent to which GCC nations are committed to exploiting their oil and gas potential to capture the market's growth.

Technological Advancements in Oil Extraction

Technological advancements in drilling and extraction techniques significantly enhance operational efficiency in the GCC Oil and Gas Projects Market. Enhanced oil recovery techniques, horizontal drilling, and hydraulic fracturing have improved the extraction process, allowing companies to access previously unreachable reserves.

The Gulf Cooperation Council countries are adopting these technologies enthusiastically, which boosts production levels and reduces operational costs. For instance, Qatar’s National Vision 2030 emphasizes the adoption of innovative technologies in the oil and gas sector, targeting an increase in gas output.

The GCC region's growing focus on Research and Development (R&D) in oil technology is expected to drive industry growth and competitiveness, with increased investments from major players like Qatar Petroleum and Abu Dhabi National Oil Company (ADNOC).

Government Initiatives and Policies

Government initiatives in GCC countries significantly propel the Oil and Gas Projects Market. Policies aimed at diversifying economies away from oil dependence are encouraging investment in the energy sector.

For example, the Saudi Vision 2030 plan aims to increase the Kingdom's non-oil revenue and has outlined several initiatives to boost local oil production. The UAE’s Energy Strategy 2050 aims to invest AED 600 billion in clean energy, ensuring sustained focus on oil and gas for the foreseeable future.

These strategic government policies not only create a conducive environment for foreign investment but also set clear goals for production targets. In turn, this results in increased funding for large-scale projects, directly influencing market growth.

Growing Focus on Sustainability and Renewable Energy

The increasing emphasis on sustainability in the GCC region is shaping the future of the Oil and Gas Projects Market. The shift towards environmentally sustainable practices is prompting GCC countries to invest in cleaner oil and gas projects as well as diversify into renewable energy sources.

Countries like the UAE are leading the charge with initiatives such as the Masdar City project, aiming to transition to sustainable energy solutions. The climate challenge has led GCC governments to commit to significant reductions in greenhouse gas emissions by 2030, as highlighted in various national strategies.

This commitment to sustainability is not only fostering innovation in the oil and gas sector but also positioning the GCC as a global leader in energy transition, which will inevitably impact market growth positively.

GCC Oil and Gas Projects Market Segment Insights:

Oil and Gas Projects Market Type Insights

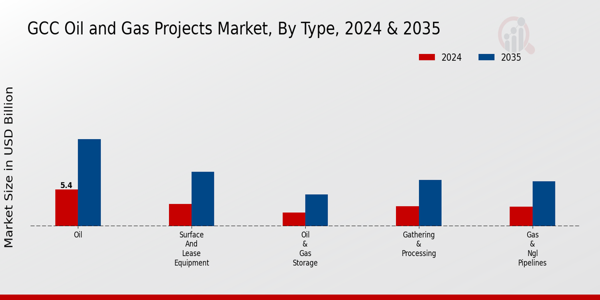

The GCC Oil and Gas Projects Market is characterized by a diverse array of types, each playing a critical role in the industry’s overall framework. Among the various categories, Surface and Lease Equipment is essential for operational efficiency, providing the necessary tools and machinery required for exploration and production processes.

The Gathering and Processing segment ensures that extracted resources are efficiently processed and transported, serving as a vital link in the resource chain. Oil, Gas, and Natural Gas Liquids (NGL) Pipelines represent the backbone of the infrastructure, facilitating the movement of these resources across expansive distances with reliability and safety.

The Oil and Gas Storage facilities are crucial for managing supply and demand dynamics, offering essential reserves that can stabilize market fluctuations. Refining and Oil Products Transport is another significant type that converts crude oil into valuable products, catering to both domestic and international markets, thereby driving economic growth within the region.

Lastly, Export Terminals are critical nodal points that enhance trade capabilities, ensuring that the Gulf Cooperation Council members can efficiently meet global demands. With the region’s oil and gas sector being a significant contributor to its GDP, the importance of these types is amplified, showcasing their fundamental roles in shaping the GCC Oil and Gas Projects Market landscape.

Each of these segments not only aids in harnessing the region's vast hydrocarbon resources but also plays a pivotal role in maintaining the GCC’s position as a key player in the global energy market.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Oil and Gas Projects Market Drilling Insights

The Drilling segment within the GCC Oil and Gas Projects Market plays a critical role in supporting the energy infrastructure of the region. As the GCC nations actively invest in enhancing their oil and gas production capabilities, the demand for drilling services continues to grow, with both Offshore and Onshore operations being integral to this process.

Offshore drilling activities are particularly significant due to the vast reserves located in the Arabian Gulf, making it essential for maintaining the region's production levels and addressing global energy demands.

Onshore activities, on the other hand, focus on exploring and extracting oil from land-based reservoirs, which remains vital for many GCC countries that rely on onshore oil fields for significant production capacity. The differentiation between these operations allows for targeted investments and technological advancements, optimizing resource management and enhancing operational efficiency.

The GCC Oil and Gas Projects Market data reflects a robust framework where these drilling methodologies adapt to evolving technologies and shifting market dynamics, presenting numerous opportunities for growth and innovation in the energy sector.

Moreover, the focus on sustainable practices and efficiency in both Offshore and Onshore drilling is becoming increasingly important, addressing environmental concerns while ensuring continued competitive advantage and profitability within the region’s energy landscape.

GCC Oil and Gas Projects Market Key Players and Competitive Insights:

The GCC Oil and Gas Projects Market is characterized by a highly competitive landscape where both national and international companies vie for dominance. This market segment is driven by the region's considerable hydrocarbon reserves, strategic geographic location, and stable regulatory frameworks that have attracted significant investments.

Enhanced by technological advancements and partnerships, the market includes an array of projects encompassing upstream exploration, production, downstream refining, and petrochemical development. Key players are continually seeking efficiencies and innovation to enhance their operational capabilities while addressing the environmental sustainability challenges that accompany oil and gas operations.

The competitive environment sees collaboration as essential for leveraging combined strengths and optimizing resource allocations, ensuring resilience amid fluctuating global oil prices and shifting energy transitions.

Eni has established a formidable presence in the GCC Oil and Gas Projects Market, emphasizing its commitment to sustainable growth and technological innovation. The company's strategic approach focuses on integrating renewable energy solutions into its traditional oil and gas portfolio, addressing regional energy demands while adhering to environmental standards.

Eni's strengths in this market include its extensive experience in optimizing production processes and its adeptness at navigating complex regulatory landscapes in the GCC. By forming partnerships and collaborations with local stakeholders, Eni enhances its operational reach and operational flexibility while driving efficiencies across its projects.

This commitment to local engagement coupled with advanced technological capabilities positions Eni as a competitive force within the GCC oil and gas sector.

Kuwait Petroleum Corporation stands as a key player in the GCC Oil and Gas Projects Market, showcasing a broad range of oil and gas services that underscore its substantial market presence. The corporation’s key products include crude oil, natural gas, and various petrochemical derivatives, serving both domestic and international markets.

This significant player has fortified its position through various strategic ventures, including joint ventures and alliances aimed at enhancing its operational capabilities and expanding its market reach. The strength of Kuwait Petroleum Corporation lies in its robust infrastructure and investment in large-scale projects, allowing it to effectively manage production and supply chain dynamics.

The company has also engaged in mergers and acquisitions to bolster its competencies and adapt to evolving market conditions, further solidifying its competitive stance within the GCC region and ensuring its resilience amid industry fluctuations.

Key Companies in the GCC Oil and Gas Projects Market Include:

Eni

Kuwait Petroleum Corporation

Qatar Petroleum

Abu Dhabi National Oil Company

Petrobras

Saudi Aramco

BP

Chevron

Oman Oil Company

ExxonMobil

Bahrain Petroleum Company

Sasol

Shell

TotalEnergies

Lukoil

GCC Oil and Gas Projects Market Developments

The GCC Oil and Gas Projects Market has seen significant developments recently, with ongoing investments aimed at energy transitions and sustainability. Saudi Aramco announced plans in October 2023 to expand its hydrogen production capabilities, emphasizing its commitment to reducing carbon emissions.

Meanwhile, Qatar Petroleum is actively pursuing its North Field expansion, which will enhance LNG production capacity and reaffirm its status as a leading global supplier. In October 2023, Kuwait Petroleum Corporation signed a strategic cooperation agreement with Chevron to explore joint projects, enhancing their operational synergy.

Recent growth in valuations for companies like Eni and TotalEnergies reflects expanding market opportunities and robust demand for energy resources. Moreover, in September 2023, Abu Dhabi National Oil Company revealed plans for a significant investment in carbon capture technologies aimed at lowering carbon footprints across operations.

In the mergers and acquisitions landscape, Petrobras finalized its sale of assets in a joint venture with Abu Dhabi National Oil Company earlier in 2023, representing a shift towards collaborations in the GCC region. Overall, the GCC Oil and Gas Projects Market remains dynamic with substantial investments and strategic partnerships shaping its future landscape.

GCC Oil and Gas Projects Market Segmentation Insights

Oil and Gas Projects Market Type Outlook

Surface and Lease Equipment

Gathering & Processing

Oil

Gas & NGL Pipelines

Oil & Gas Storage

Refining & Oil Products Transport and Export Terminals

Oil and Gas Projects Market Drilling Outlook

Offshore

Onshore

FAQs

What is the expected market size of the GCC Oil and Gas Projects Market in 2024?

The GCC Oil and Gas Projects Market is expected to be valued at 16.49 USD Billion in 2024.

What is the projected market size for the GCC Oil and Gas Projects Market by 2035?

By 2035, the market is projected to grow to 37.88 USD Billion.

What is the expected compound annual growth rate (CAGR) for the GCC Oil and Gas Projects Market from 2025 to 2035?

The expected CAGR for the market from 2025 to 2035 is 7.854%.

Which segment is projected to have the highest market value in the GCC Oil and Gas Projects Market by 2035?

The Oil segment is projected to have the highest market value at 12.8 USD Billion by 2035.

Who are the major players in the GCC Oil and Gas Projects Market?

Major players include Eni, Kuwait Petroleum Corporation, Qatar Petroleum, and Saudi Aramco, among others.

What will be the market value of Surface and Lease Equipment in 2035?

The market value for Surface and Lease Equipment is expected to reach 8.0 USD Billion by 2035.

What is the expected market value for Gathering & Processing in 2024?

The Gathering & Processing segment is expected to be valued at 2.95 USD Billion in 2024.

How will the Gas & NGL Pipelines segment perform in terms of market value by 2035?

The Gas & NGL Pipelines segment is anticipated to reach a market value of 6.6 USD Billion by 2035.

What are the key growth drivers for the GCC Oil and Gas Projects Market?

Key growth drivers include increasing energy demand, investments in infrastructure, and technological advancements.

What challenges does the GCC Oil and Gas Projects Market face?

The market faces challenges such as fluctuating oil prices and geopolitical tensions in the region.

Kindly complete the form below to receive a free sample of this Report

Customer Stories

“This is really good guys. Excellent work on a tight deadline. I will continue to use you going forward and recommend you to others. Nice job”

“Thanks. It’s been a pleasure working with you, please use me as reference with any other Intel employees.”

“Thanks for sending the report it gives us a good global view of the Betaïne market.”

“Thank you, this will be very helpful for OQS.”

“We found the report very insightful! we found your research firm very helpful. I'm sending this email to secure our future business.”

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

“I have been reading the first document or the study, ,the Global HVAC and FP market report 2021 till 2026. Must say, good info! I have not gone in depth at all parts, but got a good indication of the data inside!”

“We got the report in time, we really thank you for your support in this process. I also thank to all of your team as they did a great job.”