Rising Prevalence of Genetic Disorders

The GCC microarray market is significantly influenced by the rising prevalence of genetic disorders within the region. With an increasing number of cases of inherited diseases, there is a growing need for effective diagnostic tools. Microarray technology offers a comprehensive approach to genetic testing, enabling the identification of various genetic anomalies. For example, the prevalence of thalassemia and sickle cell disease in the Gulf countries has prompted healthcare providers to seek advanced diagnostic solutions. The market for genetic testing in the GCC is projected to reach USD 1.2 billion by 2025, reflecting the urgent demand for microarray applications. This trend suggests that as awareness of genetic disorders increases, the GCC microarray market will likely expand to meet the diagnostic needs of the population.

Increasing Focus on Research and Development

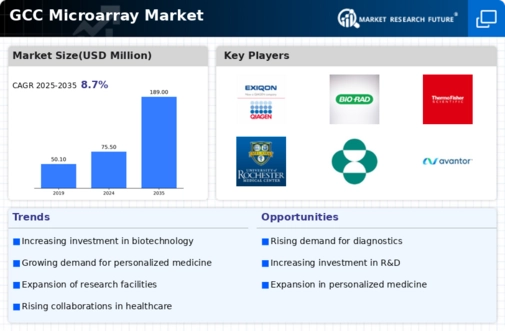

The GCC microarray market is witnessing an increasing focus on research and development (R&D) activities. Academic institutions and research organizations are investing in cutting-edge research to explore the potential applications of microarray technology in various fields, including oncology and pharmacogenomics. For example, universities in Saudi Arabia and the UAE are establishing dedicated research centers to study genetic diseases and develop novel diagnostic tools. The GCC region is expected to allocate approximately USD 1.5 billion to R&D in biotechnology by 2026, which will likely enhance the capabilities of the microarray market. This emphasis on R&D not only drives innovation but also encourages collaboration between academia and industry, further propelling the growth of the GCC microarray market.

Emergence of Advanced Microarray Technologies

The GCC microarray market is being propelled by the emergence of advanced microarray technologies that enhance the efficiency and accuracy of genetic analysis. Innovations such as next-generation sequencing and high-density microarrays are revolutionizing the way genetic information is analyzed. These technologies enable researchers to conduct large-scale genomic studies with unprecedented precision. The market for advanced microarray products is projected to grow at a CAGR of 10% from 2021 to 2026, indicating a robust demand for these innovations. As research institutions in the GCC adopt these advanced technologies, the microarray market is likely to expand, providing researchers and clinicians with powerful tools for genetic analysis and personalized medicine.

Supportive Government Policies and Regulations

The GCC microarray market benefits from supportive government policies that promote research and development in biotechnology. Various initiatives have been launched to encourage innovation and collaboration between public and private sectors. For instance, the Qatar National Research Fund provides grants for projects focusing on genomics and biotechnology, which includes microarray research. Additionally, regulatory frameworks are being established to ensure the safe and effective use of microarray technologies in clinical settings. The UAE's commitment to becoming a regional hub for biotechnology is evident in its strategic plans, which aim to enhance the capabilities of the GCC microarray market. These supportive policies are likely to foster an environment conducive to growth and innovation in the microarray sector.

Growing Investment in Healthcare Infrastructure

The GCC microarray market is experiencing a surge in investment aimed at enhancing healthcare infrastructure. Governments in the region are allocating substantial budgets to modernize healthcare facilities and integrate advanced technologies. For instance, the Saudi Vision 2030 initiative emphasizes the importance of innovative healthcare solutions, which includes the adoption of microarray technologies. This investment is expected to bolster research capabilities and improve diagnostic accuracy, thereby driving the demand for microarray products. Furthermore, the UAE's healthcare sector is projected to grow at a compound annual growth rate of 7.5% from 2021 to 2026, indicating a robust market for microarray applications. As healthcare systems evolve, the GCC microarray market is likely to benefit from increased funding and resources, facilitating advancements in genomics and personalized medicine.