Growing Complexity of Data Relationships

The increasing complexity of data relationships is a pivotal driver for the graph database market. In the GCC, organizations are confronted with vast amounts of data generated from various sources, including social media, IoT devices, and transactional systems. Traditional databases often struggle to manage these intricate relationships effectively. Graph databases, however, are designed to handle such complexities, allowing for more intuitive data modeling and querying. This capability is particularly beneficial in sectors like healthcare and logistics, where understanding relationships can lead to improved outcomes. As organizations continue to grapple with complex data environments, the graph database market is poised for growth, with a projected increase in adoption rates of around 30% in the coming years.

Increased Demand for Real-Time Analytics

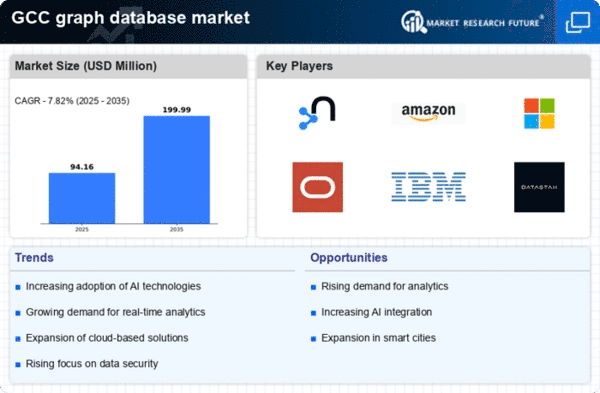

The graph database market is experiencing heightened demand for real-time analytics, particularly within the GCC region. Organizations are increasingly recognizing the value of immediate insights derived from complex data relationships. This trend is driven by the need for timely decision-making in sectors such as finance, telecommunications, and e-commerce. According to recent estimates, the market for real-time analytics is projected to grow at a CAGR of approximately 25% over the next five years. As businesses seek to enhance customer experiences and operational efficiencies, the adoption of graph databases, which excel in handling interconnected data, is likely to surge. This shift towards real-time data processing is expected to significantly impact the graph database market, as companies invest in technologies that facilitate rapid data retrieval and analysis.

Enhanced Data Security and Compliance Needs

In the context of the graph database market, enhanced data security and compliance requirements are becoming increasingly critical. With the rise of data breaches and stringent regulations in the GCC, organizations are compelled to adopt solutions that not only manage data effectively but also ensure its security. Graph databases offer advanced security features, such as fine-grained access control and data encryption, which are essential for protecting sensitive information. As businesses strive to comply with regulations like GDPR and local data protection laws, the demand for secure data management solutions is likely to drive growth in the graph database market. It is estimated that the market could see a growth rate of approximately 20% as organizations prioritize security in their data strategies.

Rising Need for Enhanced Customer Experience

The rising need for enhanced customer experience is a crucial driver for the graph database market. In the GCC, businesses are increasingly focused on understanding customer behavior and preferences to tailor their offerings. Graph databases facilitate this by enabling organizations to analyze complex customer interactions and relationships effectively. By leveraging graph technology, companies can create personalized experiences, improve customer engagement, and ultimately drive sales. This trend is particularly evident in the retail and hospitality sectors, where customer satisfaction is paramount. As organizations invest in technologies that enhance customer experience, the graph database market is likely to witness a growth rate of approximately 18% in the coming years, reflecting the importance of data-driven strategies in achieving customer-centric goals.

Integration with Artificial Intelligence Technologies

The integration of artificial intelligence (AI) technologies is emerging as a significant driver for the graph database market. In the GCC, businesses are increasingly leveraging AI to enhance their data analysis capabilities. Graph databases complement AI applications by providing a structure that allows for efficient data retrieval and relationship mapping. This synergy enables organizations to derive deeper insights and make more informed decisions. As AI adoption continues to rise, particularly in sectors such as finance and retail, the graph database market is expected to benefit substantially. Analysts predict that the intersection of AI and graph databases could lead to a market expansion of around 15% over the next few years, as companies seek to harness the power of both technologies.