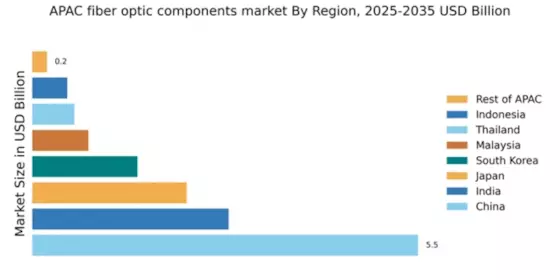

China : Unmatched Growth and Demand Trends

China holds a commanding 5.5% market share in the APAC fiber optic-components market, driven by rapid urbanization and a booming telecommunications sector. Government initiatives like the "Broadband China" strategy have spurred infrastructure investments, enhancing demand for high-speed internet and data centers. The increasing adoption of 5G technology further fuels consumption patterns, with a focus on high-capacity networks and smart city projects.

India : Rapid Growth in Connectivity Needs

India's fiber optic market accounts for 2.8% of the APAC share, reflecting a surge in demand for broadband and mobile connectivity. The government's "Digital India" initiative promotes extensive fiber network deployment, driving consumption in urban and rural areas alike. The rise of e-commerce and digital services is also contributing to this growth, with significant investments in telecommunications infrastructure.

Japan : Strong Focus on Quality and Reliability

Japan holds a 2.2% market share in the fiber optic sector, characterized by a strong emphasis on technological innovation and quality. The country's aging population and urban infrastructure development are key growth drivers, as demand for reliable communication networks increases. Government policies supporting smart city initiatives and 5G deployment are also pivotal in shaping market dynamics.

South Korea : Leading in 5G and Connectivity

With a 1.5% market share, South Korea is at the forefront of fiber optic technology, driven by its advanced telecommunications infrastructure. The government's proactive policies in promoting 5G technology and smart city projects are significant growth factors. The competitive landscape features major players like Samsung and LG, focusing on high-speed internet and IoT applications, enhancing local market dynamics.

Malaysia : Strategic Investments in Infrastructure

Malaysia's fiber optic market, accounting for 0.8%, is witnessing growth due to increasing demand for high-speed internet and digital services. The government's "National Fiberisation and Connectivity Plan" aims to enhance broadband access across urban and rural areas. This initiative, coupled with investments in telecommunications infrastructure, is driving consumption patterns and market expansion.

Thailand : Focus on Digital Transformation

Thailand's fiber optic market represents 0.6% of the APAC share, with growth driven by the government's digital transformation initiatives. The "Thailand 4.0" policy emphasizes enhancing digital infrastructure, leading to increased demand for fiber optic components. Key cities like Bangkok and Chiang Mai are central to this growth, with rising investments in telecommunications and smart city projects.

Indonesia : Rising Demand for Connectivity Solutions

Indonesia's fiber optic market, at 0.5%, is characterized by a growing need for connectivity solutions driven by urbanization and digitalization. Government initiatives aimed at improving internet access in remote areas are pivotal in shaping market dynamics. The competitive landscape includes local and international players focusing on expanding network infrastructure to meet rising demand.

Rest of APAC : Varied Growth Across Sub-regions

The Rest of APAC accounts for 0.21% of the fiber optic market, showcasing diverse growth patterns influenced by local economic conditions. Countries in this category face unique challenges, including regulatory hurdles and varying levels of infrastructure development. However, increasing digitalization and government initiatives in several nations are gradually enhancing market potential.