The GCC facility management market is characterized by a dynamic competitive landscape, driven by increasing urbanization, a growing emphasis on sustainability, and the integration of advanced technologies. Key players such as Emrill (AE), Sodexo (AE), and Cushman & Wakefield (AE) are strategically positioned to leverage these trends. Emrill (AE) focuses on innovation and digital transformation, enhancing service delivery through smart technologies. Meanwhile, Sodexo (AE) emphasizes sustainability, aiming to reduce carbon footprints across its operations. Cushman & Wakefield (AE) adopts a comprehensive approach, integrating real estate services with facility management, thereby enhancing operational efficiency. Collectively, these strategies shape a competitive environment that is increasingly focused on value-added services and technological advancements.

In terms of business tactics, companies are localizing their operations to better meet regional demands and optimize supply chains. The market appears moderately fragmented, with several players vying for market share. However, the influence of major companies is significant, as they set benchmarks for service quality and operational standards. This competitive structure encourages smaller firms to innovate and differentiate their offerings, fostering a vibrant ecosystem.

In December 2025, Emrill (AE) announced a partnership with a leading technology firm to implement AI-driven maintenance solutions across its portfolio. This strategic move is likely to enhance predictive maintenance capabilities, reducing downtime and operational costs. By integrating AI, Emrill (AE) positions itself at the forefront of technological innovation, potentially setting new industry standards.

In November 2025, Sodexo (AE) launched a new sustainability initiative aimed at achieving net-zero emissions by 2030. This initiative underscores the company's commitment to environmental stewardship and aligns with global sustainability goals. By prioritizing eco-friendly practices, Sodexo (AE) not only enhances its brand reputation but also meets the growing demand for sustainable facility management solutions.

In October 2025, Cushman & Wakefield (AE) expanded its service offerings by acquiring a regional facility management firm. This acquisition is indicative of the company's strategy to enhance its market presence and diversify its service portfolio. By integrating local expertise, Cushman & Wakefield (AE) can better cater to the unique needs of clients in the GCC region, thereby strengthening its competitive position.

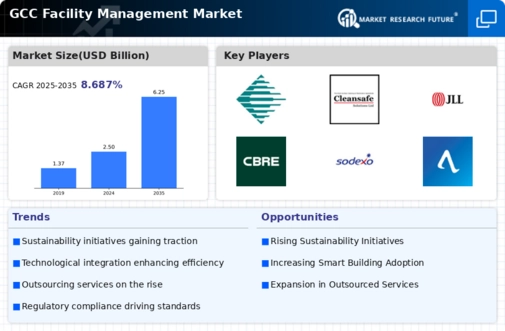

As of January 2026, the most pressing trends in the GCC facility management market include digitalization, sustainability, and the integration of AI technologies. Strategic alliances are increasingly shaping the competitive landscape, enabling companies to pool resources and expertise. Looking ahead, competitive differentiation is expected to evolve, with a shift from price-based competition to a focus on innovation, technology, and supply chain reliability. This transition may redefine how companies engage with clients, emphasizing value creation over cost-cutting.