Increased Healthcare Expenditure

Rising healthcare expenditure across the GCC is a critical driver for the electrophysiology market. Governments in the region are investing heavily in healthcare infrastructure, which includes the procurement of advanced electrophysiology devices and technologies. Recent reports indicate that healthcare spending in the GCC is projected to reach $100 billion by 2025, reflecting a commitment to enhancing healthcare services. This increase in funding is likely to facilitate the adoption of cutting-edge electrophysiology solutions, thereby stimulating market growth. As healthcare systems evolve, the demand for sophisticated electrophysiological interventions is expected to rise correspondingly.

Aging Population and Associated Health Issues

The demographic shift towards an aging population in the GCC is significantly impacting the electrophysiology market. Older adults are more susceptible to cardiac conditions, which increases the demand for electrophysiological interventions. According to recent statistics, the population aged 65 and above in the GCC is expected to reach 10% by 2030. This demographic trend suggests a growing need for specialized healthcare services, including electrophysiology. As healthcare systems adapt to cater to this aging population, investments in electrophysiology technologies and training for healthcare professionals are likely to rise, further propelling market growth.

Rising Demand for Minimally Invasive Procedures

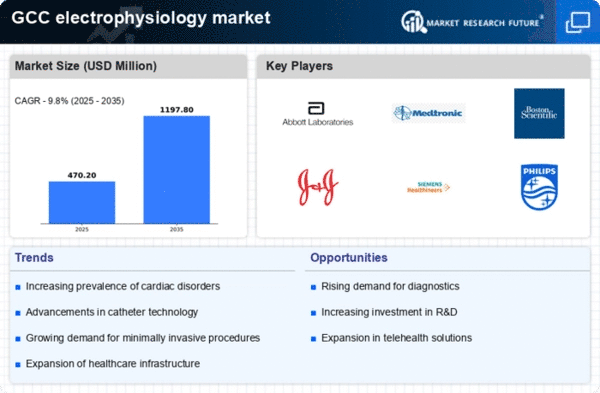

The growing preference for minimally invasive procedures is a notable driver in the electrophysiology market. Patients and healthcare providers are increasingly favoring techniques that reduce recovery time and minimize surgical risks. This trend is particularly evident in the GCC region, where advancements in catheter-based technologies have led to improved patient outcomes. The market for electrophysiology devices is projected to grow at a CAGR of approximately 8% from 2025 to 2030, driven by the rising demand for these innovative solutions. As hospitals and clinics adopt these technologies, the electrophysiology market is likely to expand, reflecting a shift towards more patient-centric care.

Growing Awareness and Education on Cardiac Health

The rising awareness and education regarding cardiac health are pivotal drivers in the electrophysiology market. Public health campaigns and educational initiatives are increasingly informing the population about the risks associated with cardiac disorders and the importance of early detection. In the GCC, healthcare authorities are actively promoting awareness programs, which have led to a notable increase in patient consultations for electrophysiological assessments. This heightened awareness is likely to result in a surge in demand for electrophysiology services, contributing to market growth. As more individuals seek preventive care, the electrophysiology market is expected to benefit from this trend.

Integration of Artificial Intelligence in Diagnostics

The integration of artificial intelligence (AI) in diagnostic procedures is emerging as a transformative driver in the electrophysiology market. AI technologies enhance the accuracy of arrhythmia detection and treatment planning, thereby improving patient outcomes. In the GCC, healthcare institutions are increasingly adopting AI-driven solutions to streamline workflows and enhance diagnostic precision. This trend is expected to contribute to a market growth rate of around 7% annually over the next five years. As AI continues to evolve, its applications in electrophysiology are likely to expand, fostering innovation and efficiency within the market.