Rising Cybersecurity Concerns

The GCC digital storage devices market is increasingly shaped by rising cybersecurity concerns among consumers and businesses. As data breaches and cyber threats become more prevalent, there is a growing demand for secure storage solutions that protect sensitive information. In 2025, a survey indicated that 70% of businesses in the GCC prioritize data security when selecting storage devices. This heightened awareness is prompting manufacturers to develop advanced security features, such as encryption and biometric access, to address these concerns. As a result, the GCC digital storage devices market is likely to witness a shift towards products that not only offer high capacity but also robust security measures, thereby enhancing consumer trust and driving market growth.

Growing Adoption of Smart Devices

The GCC digital storage devices market is experiencing a notable surge in the adoption of smart devices, which inherently require substantial storage capacities. As consumers increasingly utilize smartphones, tablets, and smart home devices, the demand for digital storage solutions is expected to rise. In 2025, the GCC region recorded a 15% increase in smart device penetration, indicating a strong correlation between device usage and storage needs. This trend suggests that manufacturers of digital storage devices must innovate to meet the evolving requirements of consumers, thereby driving growth in the market. Furthermore, the integration of smart technologies necessitates advanced storage solutions, which could lead to the development of new products tailored to specific consumer needs, enhancing the overall market landscape.

Government Initiatives and Investments

The GCC digital storage devices market is benefiting from various government initiatives aimed at enhancing the region's technological infrastructure. Governments in the GCC have recognized the importance of digital transformation and are investing in projects that promote the development of data centers and cloud storage facilities. For instance, the UAE government has launched initiatives to establish smart cities, which require advanced storage solutions to manage the data generated by IoT devices. These investments are likely to create a favorable environment for the growth of the digital storage devices market, as they encourage local and international companies to participate in the sector. Consequently, the influx of capital and resources may lead to increased innovation and competition within the GCC digital storage devices market.

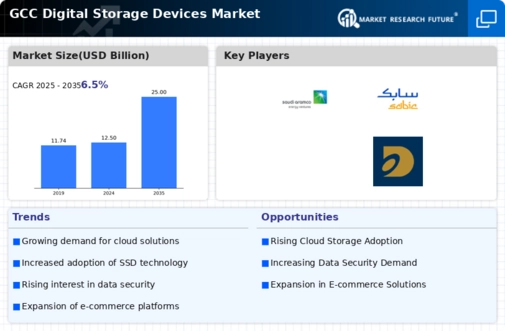

Expansion of E-commerce and Digital Content

The GCC digital storage devices market is significantly influenced by the rapid expansion of e-commerce and digital content consumption. As online shopping continues to gain traction, businesses are increasingly reliant on digital storage solutions to manage vast amounts of data. In 2025, e-commerce sales in the GCC region reached approximately USD 30 billion, highlighting the need for robust storage systems to support this growth. Additionally, the rise of streaming services and digital media consumption has further amplified the demand for high-capacity storage devices. This trend indicates that companies operating within the GCC digital storage devices market must adapt to the changing landscape by offering innovative solutions that cater to the needs of e-commerce and digital content providers.

Technological Advancements in Storage Solutions

The GCC digital storage devices market is poised for growth due to ongoing technological advancements in storage solutions. Innovations such as solid-state drives (SSDs) and high-capacity hard disk drives (HDDs) are transforming the landscape of digital storage. In 2025, the market for SSDs in the GCC region is projected to grow by 20%, driven by their superior performance and reliability compared to traditional storage options. These advancements are likely to attract both consumers and businesses seeking efficient storage solutions. Furthermore, the integration of artificial intelligence and machine learning in storage management systems may enhance data organization and retrieval processes, thereby improving overall efficiency. This trend suggests that the GCC digital storage devices market will continue to evolve, offering cutting-edge solutions that meet the demands of a tech-savvy population.