Increasing Data Generation

The exponential growth of data generation in Germany is a primary driver for the Germany Digital Storage Devices Market. With the rise of IoT devices, social media, and digital transactions, the volume of data produced is staggering. According to recent statistics, Germany is expected to generate over 100 zettabytes of data by 2025. This surge necessitates advanced storage solutions to manage and store this data efficiently. As businesses and individuals seek to harness this data for insights and decision-making, the demand for digital storage devices is likely to increase significantly. This trend indicates a robust market for storage solutions that can accommodate the growing data landscape, thereby propelling the germany digital storage devices market forward.

Adoption of Hybrid Storage Solutions

The increasing adoption of hybrid storage solutions is transforming the Germany Digital Storage Devices Market. Businesses are increasingly recognizing the benefits of combining on-premises storage with cloud solutions to optimize performance and cost. This hybrid approach allows organizations to maintain control over sensitive data while leveraging the scalability of cloud storage for less critical information. As companies in Germany seek to enhance their operational efficiency, the demand for hybrid storage solutions is likely to rise. Market data suggests that hybrid storage solutions could account for a significant portion of the overall storage market by 2026, indicating a shift in how organizations manage their data assets within the germany digital storage devices market.

Regulatory Compliance and Data Protection

Germany's stringent data protection regulations, particularly the General Data Protection Regulation (GDPR), play a crucial role in shaping the Germany Digital Storage Devices Market. Organizations are compelled to invest in secure storage solutions that comply with these regulations to avoid hefty fines and reputational damage. The emphasis on data privacy has led to a heightened demand for storage devices that offer encryption and secure access controls. As companies strive to ensure compliance, the market for secure digital storage solutions is expected to expand. This regulatory environment not only drives innovation in storage technology but also fosters consumer trust, which is essential for the growth of the germany digital storage devices market.

Technological Advancements in Storage Devices

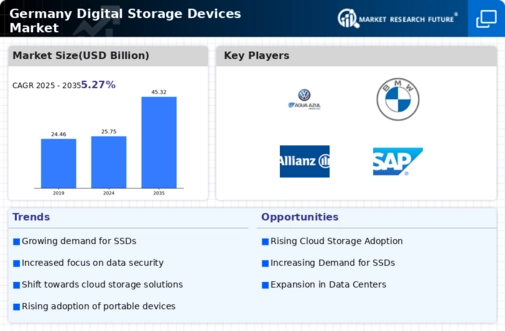

Technological advancements in storage devices are a key driver of the Germany Digital Storage Devices Market. Innovations such as solid-state drives (SSDs), NVMe technology, and increased storage capacities are reshaping consumer expectations and business needs. As these technologies become more affordable, they are being adopted across various sectors, including healthcare, finance, and education. The introduction of faster and more reliable storage solutions is likely to enhance productivity and data management capabilities. Furthermore, the trend towards miniaturization and energy efficiency in storage devices aligns with Germany's commitment to sustainability, potentially driving further growth in the market. This technological evolution is expected to create new opportunities within the germany digital storage devices market.

Rising Demand for Backup and Recovery Solutions

The rising demand for backup and recovery solutions is significantly influencing the Germany Digital Storage Devices Market. As data breaches and system failures become more prevalent, organizations are increasingly prioritizing data protection strategies. The need for reliable backup solutions that ensure data integrity and availability is paramount. Market analysis indicates that the backup and recovery segment is projected to grow substantially, driven by the necessity for businesses to safeguard their critical data. This trend is particularly relevant in sectors such as finance and healthcare, where data loss can have severe consequences. Consequently, the demand for advanced backup solutions is likely to propel the growth of the germany digital storage devices market.