Rising Adoption of 5G Technology

The rollout of 5G technology in Japan is poised to have a profound impact on the digital storage devices market. With faster internet speeds and improved connectivity, the demand for cloud-based storage solutions is expected to rise. This shift is likely to drive the sales of hybrid storage devices that combine local and cloud storage capabilities. As of January 2026, it is projected that the market for cloud storage services in Japan will grow by approximately 25% annually, further influencing the types of storage devices consumers choose to invest in.

Integration of Advanced Technologies

The integration of advanced technologies such as artificial intelligence and machine learning into storage devices is shaping the Japan digital storage devices market. These technologies enhance data retrieval speeds and optimize storage efficiency, making devices more appealing to consumers. For instance, the introduction of AI-driven data management systems has been observed to improve user experience significantly. As of early 2026, it is estimated that around 30% of new storage devices in Japan incorporate such technologies, indicating a shift towards smarter storage solutions that cater to the evolving needs of users.

Growing Demand for High-Capacity Storage

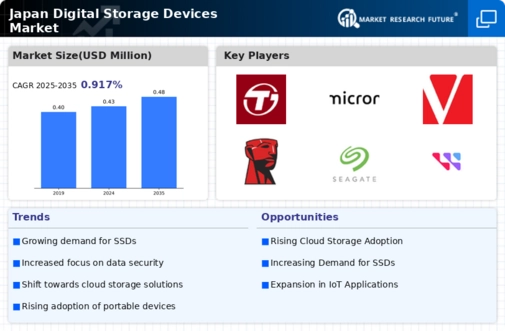

The Japan digital storage devices market is experiencing a notable surge in demand for high-capacity storage solutions. As data generation continues to escalate, driven by advancements in technology and the proliferation of digital content, consumers and businesses alike are seeking storage devices that can accommodate vast amounts of information. In 2025, the market for external hard drives and SSDs in Japan reached approximately 1.2 billion USD, reflecting a growing preference for devices that offer enhanced storage capabilities. This trend is likely to persist as the need for efficient data management becomes increasingly critical in both personal and professional contexts.

Increased Focus on Data Privacy Regulations

The Japan digital storage devices market is also being influenced by heightened awareness of data privacy regulations. With the implementation of stricter data protection laws, consumers are becoming more cautious about how their data is stored and managed. This has led to a growing preference for storage devices that offer enhanced security features, such as encryption and secure access controls. As of January 2026, it is estimated that around 40% of consumers prioritize data security when selecting storage devices, indicating a significant shift in purchasing behavior that manufacturers must consider.

Expansion of E-commerce and Digital Services

The expansion of e-commerce and digital services in Japan is driving growth in the digital storage devices market. As more businesses transition to online platforms, the need for reliable and efficient storage solutions becomes paramount. In 2025, the e-commerce sector in Japan was valued at over 200 billion USD, contributing to increased demand for storage devices that can support large volumes of transactions and customer data. This trend is expected to continue, with businesses seeking scalable storage solutions that can adapt to their growing needs.