Emergence of Edge Computing

The emergence of edge computing is reshaping the GCC data center market by enabling faster data processing and reduced latency. As the Internet of Things (IoT) continues to proliferate, the need for localized data processing becomes increasingly apparent. Edge computing allows data to be processed closer to the source, thereby enhancing response times and improving overall efficiency. This trend is particularly relevant in sectors such as manufacturing and smart cities, where real-time data analysis is crucial. Consequently, data center operators in the GCC are likely to invest in edge computing infrastructure to meet the demands of this evolving landscape. The GCC data center market must adapt to these changes by integrating edge solutions into their offerings, ensuring they remain competitive in a rapidly changing technological environment.

Rising Data Sovereignty Concerns

Data sovereignty has emerged as a critical driver within the GCC data center market, as organizations increasingly prioritize data localization. Governments in the region are implementing regulations that mandate data to be stored within national borders, thereby ensuring compliance with local laws and enhancing data security. This trend is particularly evident in sectors such as finance and healthcare, where sensitive information must be protected. As a result, data center operators are compelled to establish facilities that comply with these regulations, leading to an increase in local data center investments. The GCC data center market is likely to see a rise in demand for services that ensure data sovereignty, as businesses seek to mitigate risks associated with data breaches and regulatory non-compliance.

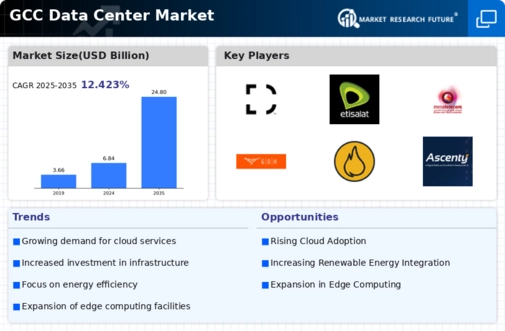

Growing Demand for Cloud Services

The GCC data center market is experiencing a notable surge in demand for cloud services. As businesses increasingly migrate to cloud-based solutions, the need for robust data center infrastructure intensifies. According to recent statistics, the cloud computing market in the GCC is projected to reach USD 10 billion by 2025, indicating a compound annual growth rate of approximately 25%. This growth is driven by the digital transformation initiatives undertaken by various sectors, including finance, healthcare, and education. Consequently, data centers are evolving to accommodate the rising data storage and processing requirements, thereby enhancing their operational capabilities. The GCC data center market must adapt to these trends by investing in scalable and flexible infrastructure to meet the evolving needs of cloud service providers.

Government Initiatives and Investments

The GCC data center market benefits significantly from proactive government initiatives aimed at fostering technological advancement. Governments across the region are investing heavily in digital infrastructure to support economic diversification and innovation. For instance, the UAE's Vision 2021 and Saudi Arabia's Vision 2030 emphasize the importance of developing a robust digital economy. These initiatives are likely to lead to increased funding for data center projects, enhancing the overall capacity and capabilities of the industry. Furthermore, the establishment of free zones and regulatory frameworks encourages foreign investment, which is crucial for the growth of the GCC data center market. As a result, the region is poised to become a global hub for data center operations, attracting international players and enhancing local capabilities.

Focus on Energy Efficiency and Sustainability

The GCC data center market is increasingly focusing on energy efficiency and sustainability as environmental concerns gain prominence. Data centers are among the largest consumers of energy, and there is a growing recognition of the need to minimize their carbon footprint. Initiatives aimed at enhancing energy efficiency, such as the adoption of renewable energy sources and advanced cooling technologies, are becoming more prevalent. For instance, several data centers in the region are now utilizing solar energy to power their operations, aligning with national sustainability goals. This shift not only reduces operational costs but also enhances the reputation of data center operators as environmentally responsible entities. The GCC data center market is likely to see a continued emphasis on sustainable practices, driven by both regulatory pressures and market demand.