Rising Demand for Data Processing

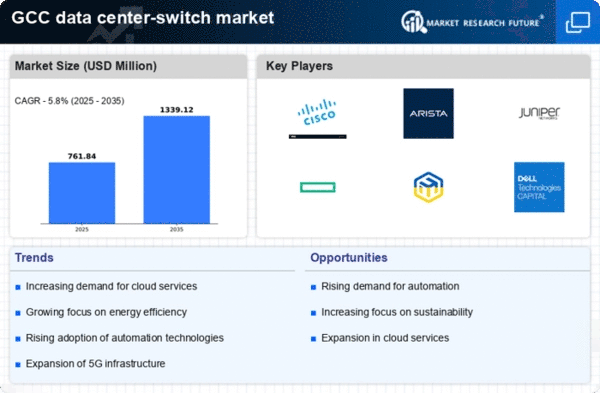

The data center-switch market is experiencing a notable surge in demand driven by the increasing need for data processing capabilities across various sectors in the GCC. As organizations continue to generate vast amounts of data, the requirement for efficient data management and processing solutions becomes paramount. This trend is reflected in the projected growth of the data center-switch market, which is expected to reach approximately $1.5 billion by 2026. The proliferation of big data analytics and the Internet of Things (IoT) further amplify this demand, necessitating advanced switching solutions that can handle high data throughput and low latency. Consequently, the data center-switch market is positioned to benefit significantly from this rising demand, as businesses seek to enhance their operational efficiency and data handling capabilities.

Focus on Enhanced Security Solutions

The growing emphasis on cybersecurity is driving demand for enhanced security solutions within the data center-switch market. As cyber threats become more sophisticated, organizations in the GCC are prioritizing the protection of their data and IT infrastructure. This focus on security is leading to increased investments in advanced switching technologies that offer robust security features, such as encryption and intrusion detection. The data center-switch market is likely to benefit from this trend, as businesses seek to safeguard their operations against potential breaches. Furthermore, the market is expected to see a rise in demand for switches that can integrate with existing security protocols and provide real-time monitoring capabilities. This heightened focus on security is anticipated to shape the future of the data center-switch market, as organizations strive to create secure and resilient IT environments.

Shift Towards Hybrid IT Environments

The shift towards hybrid IT environments is emerging as a significant driver for the data center-switch market. Organizations in the GCC are increasingly adopting hybrid models that combine on-premises data centers with cloud services. This transition necessitates the deployment of sophisticated switching solutions that can seamlessly integrate various IT environments. The data center-switch market is likely to experience growth as businesses seek to optimize their IT infrastructure for flexibility and scalability. This trend is further supported by the increasing reliance on cloud services, which is projected to account for over 50% of IT spending in the region by 2027. As a result, the data center-switch market is positioned to thrive in this evolving landscape, catering to the needs of organizations transitioning to hybrid IT models.

Government Initiatives and Investments

Government initiatives in the GCC region are playing a crucial role in shaping the data center-switch market. Various national strategies aim to bolster digital transformation and enhance the region's technological infrastructure. For instance, investments in smart city projects and digital economies are driving the need for robust data center solutions. The data center-switch market is likely to see increased funding and support from government bodies, which may lead to the establishment of new data centers and the upgrading of existing facilities. This supportive environment is expected to foster innovation and competition within the market, ultimately benefiting end-users through improved services and reduced costs. As a result, the data center-switch market is poised for growth, driven by these strategic governmental efforts.

Expansion of Telecommunications Infrastructure

The expansion of telecommunications infrastructure in the GCC is significantly impacting the data center-switch market. With the rollout of 5G networks and enhanced broadband services, there is a growing need for advanced data center solutions that can support increased connectivity and data traffic. The data center-switch market is likely to benefit from this expansion, as telecom operators and service providers seek to upgrade their infrastructure to accommodate higher bandwidth demands. This trend is underscored by the anticipated increase in data consumption, which is projected to rise by over 30% annually in the region. Consequently, the data center-switch market is expected to see a corresponding increase in demand for high-performance switches that can facilitate seamless data transmission and connectivity.