Surge in Data Consumption

The data center-rack market experiences a notable surge in demand driven by the exponential growth in data consumption across various sectors in the GCC. As businesses increasingly rely on digital solutions, the need for robust data storage and processing capabilities intensifies. Reports indicate that data traffic in the region is projected to grow by over 30% annually, necessitating the deployment of advanced data center infrastructure. This trend compels organizations to invest in high-capacity racks that can accommodate the growing volume of data while ensuring optimal performance. Consequently, the data center-rack market is poised for expansion as companies seek to enhance their operational efficiency and scalability to meet the rising data demands.

Focus on Security and Compliance

In the GCC, the data center-rack market is increasingly influenced by the heightened focus on security and compliance. Organizations are compelled to adhere to stringent regulations regarding data protection and privacy, which necessitates the implementation of secure data center environments. This trend drives the demand for specialized racks that offer enhanced security features, such as access controls and monitoring systems. As businesses prioritize compliance with local and international standards, the market for data center racks is expected to grow, with an estimated increase of 10% in demand for security-focused solutions. This emphasis on security not only protects sensitive information but also fosters trust among clients and stakeholders.

Rise of Cloud Computing Services

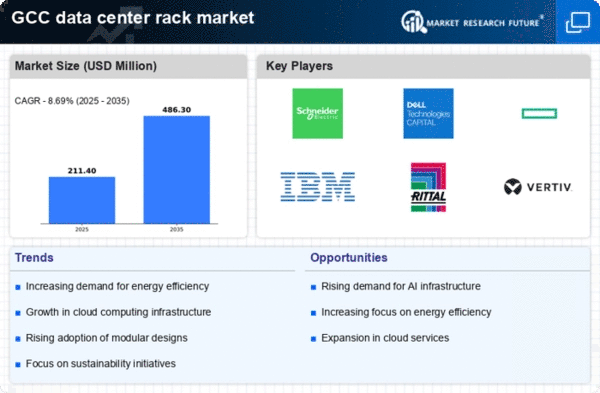

The increasing adoption of cloud computing services significantly influences the data center-rack market in the GCC. As businesses transition to cloud-based solutions, the demand for efficient and scalable data center infrastructure rises. Cloud service providers require advanced racks to support their operations, leading to a projected market growth of approximately 20% in the coming years. This shift not only enhances operational flexibility but also drives the need for high-density racks that can accommodate virtualized environments. Consequently, the data center-rack market is likely to benefit from this trend as organizations seek to optimize their IT resources and improve service delivery through cloud technologies.

Government Initiatives and Investments

Government initiatives in the GCC region play a pivotal role in shaping the data center-rack market. Various countries are investing heavily in digital transformation strategies, aiming to position themselves as technology hubs. For instance, the UAE's Vision 2021 and Saudi Arabia's Vision 2030 emphasize the importance of advanced IT infrastructure, including data centers. These initiatives are likely to stimulate demand for data center racks as organizations align with national goals. Furthermore, public-private partnerships are emerging to facilitate investments in data center infrastructure, potentially leading to a market growth rate of 15% over the next five years. Such government support is crucial for fostering innovation and enhancing the overall competitiveness of the data center-rack market.

Technological Advancements in Rack Design

Technological advancements in rack design are reshaping the data center-rack market in the GCC. Innovations such as modular rack systems and smart racks equipped with monitoring capabilities are gaining traction. These advancements allow for better space utilization and energy efficiency, addressing the growing concerns of operational costs. The market is witnessing a shift towards racks that can adapt to changing technological needs, with a projected growth rate of 12% in the adoption of smart rack solutions. As organizations seek to optimize their data center operations, the integration of advanced technologies into rack design is likely to drive the evolution of the data center-rack market, enhancing overall performance and sustainability.