Rising Cyber Threats

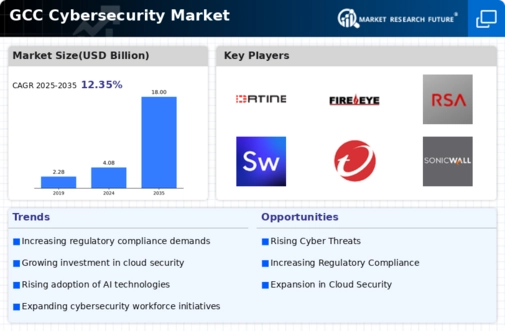

The GCC cybersecurity market is increasingly influenced by the rising frequency and sophistication of cyber threats. Reports indicate that cyberattacks in the region have escalated, with a notable increase in ransomware and phishing incidents targeting both public and private sectors. For instance, the Saudi National Cybersecurity Authority has reported a 300% increase in cyber incidents over the past year. This alarming trend has prompted organizations to prioritize cybersecurity investments, leading to a heightened demand for advanced threat detection and response solutions. Consequently, the GCC cybersecurity market is poised for growth as businesses seek to fortify their defenses against evolving cyber threats.

Investment in Smart Cities

The GCC cybersecurity market is witnessing a notable increase in investments related to the development of smart cities. Governments in the region are prioritizing smart city projects, which integrate advanced technologies to enhance urban living. However, these innovations also introduce new cybersecurity challenges, as interconnected systems become potential targets for cybercriminals. For example, the UAE's Smart Dubai initiative aims to create a secure digital infrastructure, necessitating robust cybersecurity measures. As cities evolve into smart ecosystems, the demand for cybersecurity solutions tailored to protect critical infrastructure and public services is expected to grow, thereby driving the GCC cybersecurity market.

Increased Regulatory Compliance

The GCC cybersecurity market is experiencing a surge in regulatory compliance requirements, driven by the need to protect sensitive data and maintain national security. Governments across the region are implementing stringent regulations, such as the UAE's Data Protection Law and Saudi Arabia's Personal Data Protection Law, which mandate organizations to adopt robust cybersecurity measures. This regulatory landscape compels businesses to invest in advanced cybersecurity solutions to ensure compliance, thereby driving market growth. As organizations strive to meet these legal obligations, the demand for cybersecurity services and products is expected to rise significantly, creating opportunities for vendors in the GCC cybersecurity market.

Digital Transformation Initiatives

The ongoing digital transformation initiatives across the GCC region are significantly impacting the cybersecurity market. As organizations embrace digital technologies, such as cloud computing and the Internet of Things (IoT), they inadvertently expose themselves to new vulnerabilities. The GCC governments are actively promoting digitalization, with initiatives like Saudi Vision 2030 and the UAE's Digital Government Strategy. These efforts necessitate the implementation of comprehensive cybersecurity frameworks to safeguard digital assets. As a result, the demand for cybersecurity solutions is expected to surge, as businesses recognize the importance of integrating security measures into their digital transformation strategies within the GCC cybersecurity market.

Growing Awareness of Cybersecurity Risks

There is a growing awareness of cybersecurity risks among organizations in the GCC cybersecurity market. As businesses increasingly recognize the potential financial and reputational damage caused by cyber incidents, they are more inclined to invest in cybersecurity measures. Educational campaigns and training programs initiated by governments and industry bodies are contributing to this heightened awareness. For instance, the Cybersecurity Awareness Month in the UAE aims to educate citizens and businesses about online safety. This cultural shift towards prioritizing cybersecurity is likely to result in increased spending on cybersecurity solutions, further propelling the growth of the GCC cybersecurity market.