Integration of Mobile Solutions

The crm software market is witnessing a significant trend towards the integration of mobile solutions. With the increasing reliance on mobile devices for business operations, organizations in the GCC are seeking crm software that offers mobile accessibility. This trend is driven by the need for sales teams and customer service representatives to access customer data and manage interactions on-the-go. As mobile technology continues to advance, the crm software market is likely to see a rise in demand for mobile-friendly applications. This shift not only enhances productivity but also allows businesses to respond to customer needs in real-time. The integration of mobile solutions is expected to contribute to a more agile and responsive crm software market, aligning with the fast-paced nature of modern business.

Growing Emphasis on Data Security

In the crm software market, there is an increasing emphasis on data security and compliance. As businesses in the GCC handle sensitive customer information, the need for robust security measures has become paramount. Organizations are prioritizing crm solutions that offer advanced security features to protect against data breaches and cyber threats. This focus on data security is likely to drive the adoption of crm software that complies with local regulations and international standards. The market is expected to see a rise in demand for solutions that provide encryption, access controls, and regular security updates. Consequently, the crm software market is evolving to meet these security challenges, ensuring that customer data remains safe and secure.

Rising Demand for Customer Engagement

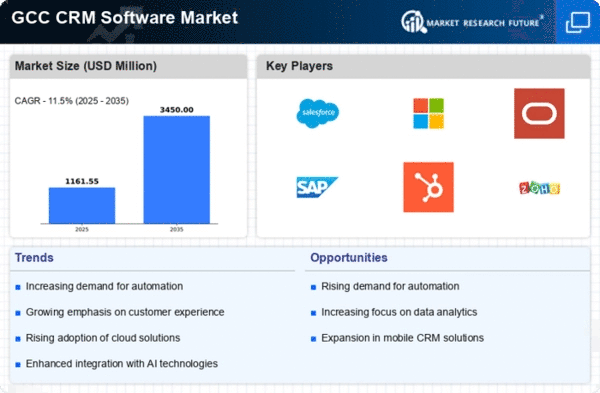

The CRM Software Market is experiencing a notable surge in demand for enhanced customer engagement solutions. Businesses in the GCC are increasingly recognizing the importance of maintaining strong relationships with their customers. This shift is driven by the need to provide personalized experiences and timely responses to customer inquiries. As a result, the crm software market is projected to grow at a CAGR of approximately 12% over the next five years. Companies are investing in tools that facilitate better communication and interaction with clients, thereby improving customer satisfaction and loyalty. The emphasis on customer-centric strategies is reshaping the landscape of the crm software market, compelling vendors to innovate and offer solutions that cater to these evolving needs.

Shift Towards Subscription-Based Models

The crm software market is experiencing a shift towards subscription-based pricing models. This trend is particularly evident in the GCC, where businesses are increasingly opting for Software as a Service (SaaS) solutions. Subscription models offer flexibility and scalability, allowing organizations to pay for only what they need. This approach reduces upfront costs and enables companies to adapt their crm software usage based on changing business requirements. As a result, the crm software market is likely to see a rise in the adoption of subscription-based solutions, which can enhance customer retention and satisfaction. This shift not only benefits businesses but also encourages crm vendors to innovate and improve their offerings to remain competitive.

Increased Focus on Analytics and Reporting

The crm software market is witnessing an increased focus on analytics and reporting capabilities. Businesses in the GCC are recognizing the value of data-driven decision-making and are seeking crm solutions that provide comprehensive analytics tools. This trend is driven by the need to gain insights into customer behavior, sales performance, and marketing effectiveness. By leveraging advanced analytics, organizations can make informed decisions that enhance their overall business strategies. The crm software market is likely to see a rise in demand for solutions that offer customizable dashboards, real-time reporting, and predictive analytics features. This emphasis on analytics is reshaping the crm software market, enabling businesses to optimize their operations and improve customer engagement.