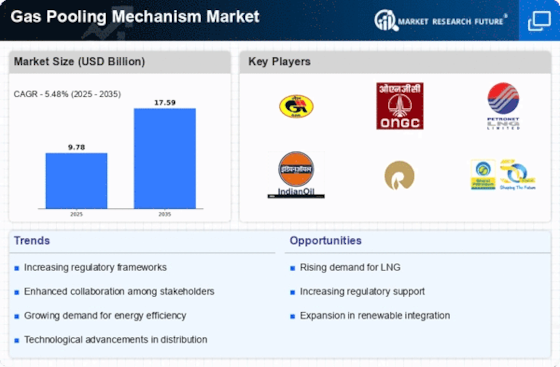

Cost Efficiency in Gas Supply

Cost efficiency remains a crucial factor influencing the Gas Pooling Mechanism Market. By pooling gas supplies, companies can achieve economies of scale, reducing overall procurement costs. This mechanism allows smaller players to access competitive pricing, which is particularly beneficial in a market characterized by fluctuating prices. In 2025, the average price of natural gas is expected to stabilize, making cost-effective solutions more appealing. The Gas Pooling Mechanism Market thus plays a vital role in enabling participants to share resources and minimize expenses, ultimately enhancing profitability. As companies increasingly prioritize cost management, the adoption of gas pooling mechanisms is likely to rise, further driving market growth.

Increased Demand for Natural Gas

The rising demand for natural gas across various sectors is a primary driver for the Gas Pooling Mechanism Market. As industries seek cleaner energy alternatives, natural gas has emerged as a preferred choice due to its lower carbon emissions compared to coal and oil. In 2025, the demand for natural gas is projected to reach approximately 4,000 billion cubic meters, indicating a robust growth trajectory. This surge in demand necessitates efficient distribution mechanisms, such as gas pooling, to optimize supply and ensure reliability. The Gas Pooling Mechanism Market is thus positioned to benefit from this increasing demand, as it facilitates the aggregation of gas supplies, enabling better management of resources and pricing stability.

Technological Advancements in Gas Management

Technological advancements are significantly shaping the Gas Pooling Mechanism Market. Innovations in data analytics, IoT, and blockchain technology are enhancing the efficiency of gas distribution and management. These technologies enable real-time monitoring and optimization of gas flows, which is essential for effective pooling strategies. In 2025, it is anticipated that the integration of advanced technologies will streamline operations, reduce waste, and improve decision-making processes. The Gas Pooling Mechanism Market stands to gain from these developments, as they facilitate better coordination among suppliers and consumers, ultimately leading to a more resilient and responsive gas market.

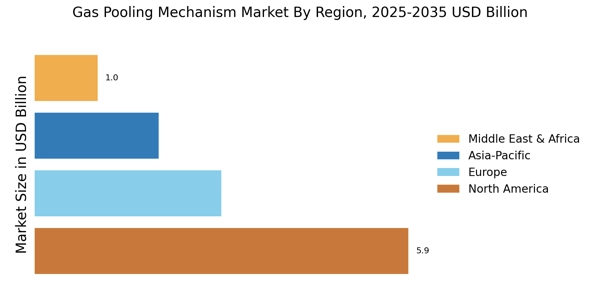

Regulatory Support for Gas Pooling Initiatives

Regulatory frameworks are increasingly supporting the implementation of gas pooling initiatives, which is a significant driver for the Gas Pooling Mechanism Market. Governments are recognizing the need for collaborative approaches to energy management, promoting policies that encourage pooling arrangements. In 2025, several regions are expected to introduce regulations that facilitate the establishment of gas pooling mechanisms, thereby enhancing market stability and security. This regulatory support not only fosters a conducive environment for investment but also encourages stakeholders to participate in pooling arrangements. As a result, the Gas Pooling Mechanism Market is likely to experience accelerated growth due to favorable regulatory conditions.

Environmental Considerations and Emission Reductions

Environmental considerations are becoming increasingly important in the energy sector, driving the Gas Pooling Mechanism Market. The global push for emission reductions and sustainable practices is prompting companies to adopt cleaner energy sources, with natural gas being a key player. In 2025, it is projected that the share of natural gas in the energy mix will increase, driven by policies aimed at reducing greenhouse gas emissions. The Gas Pooling Mechanism Market is well-positioned to support this transition by providing a framework for efficient gas distribution and utilization. By facilitating the pooling of resources, the industry can contribute to achieving environmental goals while ensuring energy security.