Research Methodology on Gas Insulated Switchgear Market

Introduction

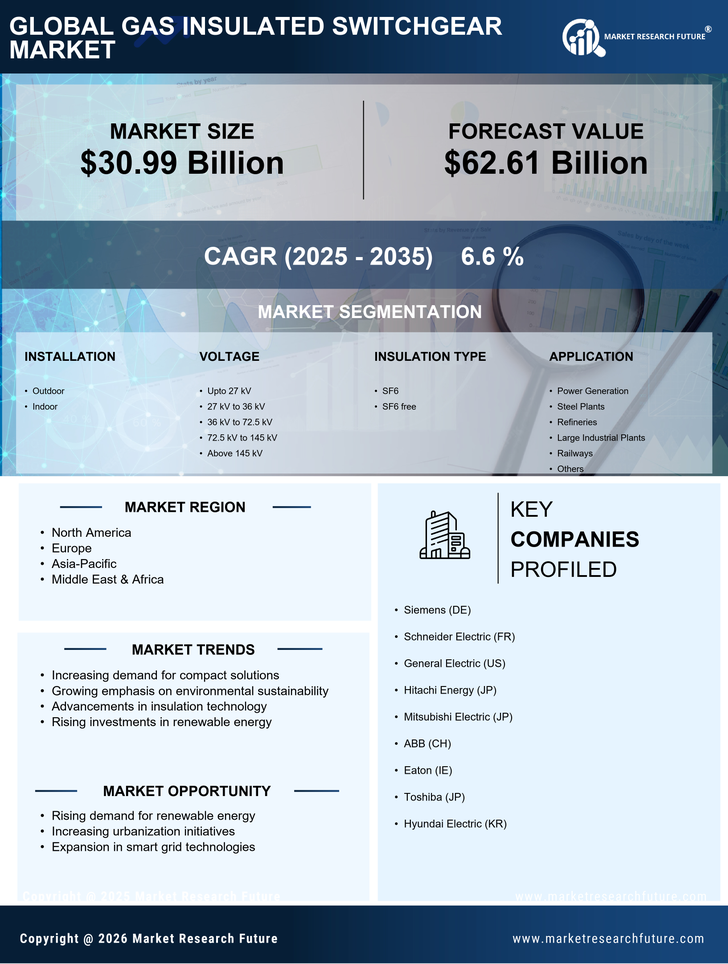

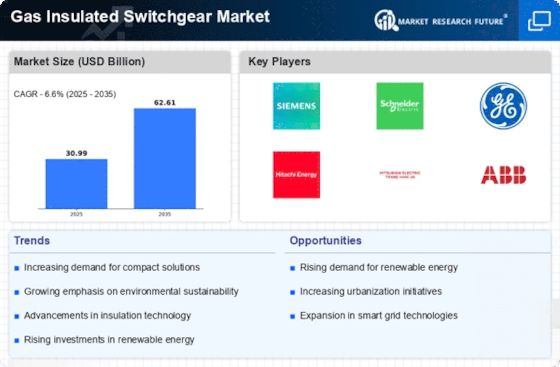

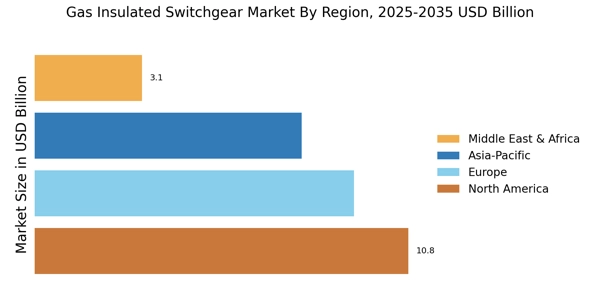

Research methodology is a process used by academics, researchers and students to systematically investigate an area of interest. Market research is the practice of gathering, analyzing and interpreting information about a market, product, industry or organization. This research report aims to provide an in-depth analysis of the global Gas Insulated Switchgear market, focusing on market size, trends, drivers, and restraints.

Research objectives

The objectives of this research report include:

- To analyze the historical, present and future market trends for the Gas Insulated Switchgear market.

- To assess the overall market size and growth opportunity for the gas Insulated Switchgear market for the forecast period 2023-2030.

- To identify key players and analyze their market share and competition.

- To assess opportunities in the market for stakeholders through analyzing market trends, strategic initiatives and changes in regulations.

Research Design

A flexible research design is implemented to capture the ever–evolving and changing dynamics of the Gas Insulated Switchgear market. The primary research consisted of in–depth interviews with industry experts, industry leaders, key players, manufacturers and technical experts within the industry. Additional sources include third-party research portals such as MarketWatch, Bloomberg and Yahoo Finance, professional journals and statistical databases such as the Bureau of Labour Statistics.

Research Methodology

The research methodology employed a combination of both primary and secondary research. Primary research gathered information from in-depth interviews with industry experts and key opinion leaders, while secondary research made use of information gathered from articles, books, encyclopaedias and published databases as additional sources.

Primary research

A wide variety of primary research sources were employed to gather data. These sources included interviews with key personnel, company executives and other industry leaders. The data gathered is triangulated to ensure validity.

The primary research gathered information through the following process:

- Interviews – A series of interviews were conducted with industry stakeholders, expert advisors, Market Research Group C-Level executives and industry experts to understand the dynamics and structure of the Gas Insulated Switchgear market.

- Questionnaires – Questionnaires were designed to gain further insights into the market from the perspectives of market participants, industry players and customers.

- Focus groups – Focus groups involving decision makers, industry experts and major industry players were conducted to gain their insights on the dynamics of the Gas Insulated Switchgear market.

Secondary research

Secondary research is carried out to gain an in-depth understanding of the market in terms of size, growth, trends and segments. Secondary research includes online sources such as trade magazines, Encyclopedia of Business and Business Modelling, Investment Guide, and published database websites. Other sources included market reports and statistical databases.

Data Collection and Analysis

The data collected was analysed through two different methods: Qualitative Analysis and Quantitative Analysis. Qualitative Analysis involves a review of the literature and an understanding of the dynamics and structure of the research. Quantitative Analysis involves the manipulation of the available data to highlight trends and provide a comprehensive overall understanding of the market.

Reliability and Validity

To ensure reliability and validity, the collected data is triangulated with sources including statistical databases, published reports and industry associations.

Findings

The findings of the research report provide a comprehensive overview of the global Gas Insulated Switchgear market, its size, trends, drivers and restraints. Additionally, the research report will provide detailed segmentation of the overall Gas Insulated Switchgear market as well as comprehensive profiles of the leading players in the industry.

Conclusion

This research report provides a comprehensive overview of the global Gas Insulated Switchgear market, its size, trends, drivers, and restraints. The report provides detailed insights into the key players and their market share and competition. Additionally, the research report provides detailed segmentation of the overall market, offering a full insight into the market potential.