Rising Use in Metal Fabrication

The Global Gas and Liquid Argon Market Industry is significantly influenced by the rising use of argon in metal fabrication processes, particularly in welding and cutting applications. Argon serves as a shielding gas that enhances the quality of welds and prevents oxidation, making it essential in industries such as automotive and construction. As manufacturing processes become more sophisticated, the demand for high-quality welding solutions is likely to increase. This trend is expected to support a compound annual growth rate of 5.29% from 2025 to 2035, reflecting the ongoing importance of argon in industrial applications.

Expansion of Healthcare Applications

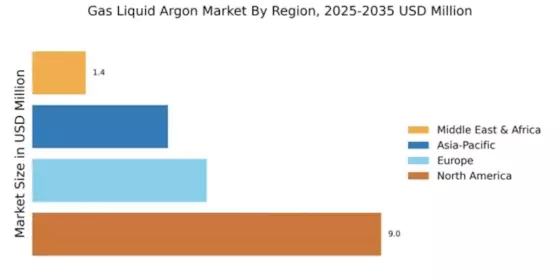

The Global Gas and Liquid Argon Market Industry is witnessing a significant expansion in healthcare applications, particularly in medical imaging and cryotherapy. Argon is utilized in various medical devices, including lasers for surgical procedures and cryoablation therapies. The increasing prevalence of chronic diseases and the growing emphasis on advanced medical technologies are likely to drive the demand for argon in healthcare. As hospitals and clinics invest in state-of-the-art equipment, the market is expected to benefit from this trend, contributing to an anticipated market value of 621.8 USD Million by 2035.

Technological Advancements in Production

Technological advancements in the production of gas and liquid argon are poised to drive growth within the Global Gas and Liquid Argon Market Industry. Innovations in cryogenic distillation and gas separation technologies enhance the efficiency and purity of argon production, reducing operational costs for manufacturers. As these technologies become more widely adopted, they may facilitate increased supply and lower prices, making argon more accessible to various industries. This could lead to a broader application range and stimulate market growth, aligning with the projected increase in market value.

Growing Demand in Electronics Manufacturing

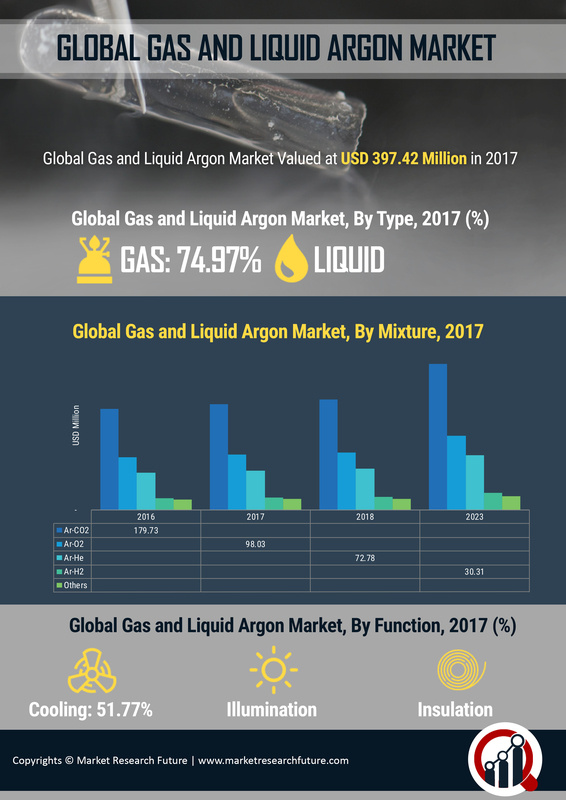

The Global Gas and Liquid Argon Market Industry experiences a notable surge in demand driven by the electronics manufacturing sector. Argon is extensively utilized in the production of semiconductors and other electronic components due to its inert properties, which prevent contamination during manufacturing processes. As the global electronics market expands, particularly in regions such as Asia-Pacific, the need for high-purity argon is expected to rise. This trend is reflected in the projected market value of 352.8 USD Million in 2024, indicating a robust growth trajectory as industries increasingly rely on argon for precision applications.

Environmental Regulations Favoring Inert Gases

The Global Gas and Liquid Argon Market Industry is positively impacted by stringent environmental regulations that favor the use of inert gases like argon. These regulations encourage industries to adopt cleaner technologies and processes, particularly in sectors such as welding and metal fabrication, where argon serves as a safer alternative to more hazardous gases. As companies strive to comply with environmental standards, the demand for argon is likely to rise, contributing to the overall growth of the market. This trend aligns with the increasing awareness of environmental sustainability across various industries.