Garbage Collection Vehicle Size

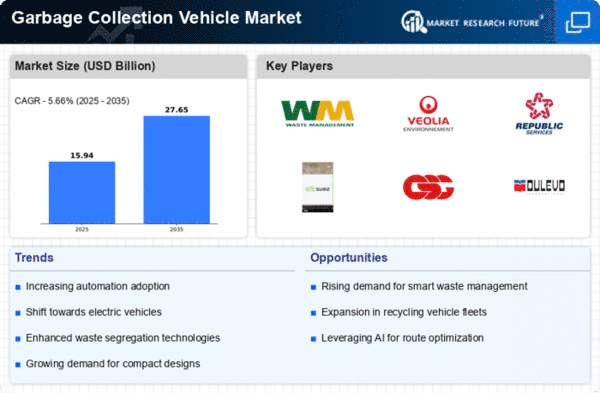

Garbage Collection Vehicle Market Growth Projections and Opportunities

The market dynamics of the garbage collection vehicle industry are influenced by a combination of factors that shape the demand and supply in this sector. One of the primary drivers of this market is the increasing global emphasis on sustainable waste management practices. With growing urbanization and population, there is a corresponding rise in the generation of municipal solid waste. Governments and municipalities worldwide are, therefore, investing in efficient garbage collection vehicles to address this escalating concern.

Furthermore, environmental regulations and stringent emission norms are playing a pivotal role in shaping the market dynamics. As governments and regulatory bodies push for cleaner and greener technologies, manufacturers are compelled to innovate and produce garbage collection vehicles with lower emissions and better fuel efficiency. This has led to a notable shift in the industry towards electric and hybrid garbage trucks, reflecting the broader trend towards sustainability in the automotive sector.

In addition to regulatory factors, the economic landscape significantly influences the market dynamics of garbage collection vehicles. Economic development and urban expansion lead to increased waste generation, necessitating the procurement of advanced and larger fleets of garbage trucks. Moreover, economic fluctuations impact municipal budgets, affecting the purchasing power of local authorities for waste management equipment. Therefore, the market experiences cyclical patterns influenced by economic conditions and government spending on infrastructure.

The competitive landscape also plays a crucial role in shaping market dynamics. The garbage collection vehicle market is characterized by the presence of both established players and emerging entrants, intensifying competition. Manufacturers strive to differentiate their products through technological advancements, cost-efficiency, and environmental sustainability features. This competition drives innovation and contributes to the overall evolution of garbage collection vehicle designs and functionalities.

Technological advancements are another significant factor influencing market dynamics. The integration of smart technologies, such as route optimization software, IoT sensors, and telematics, has become increasingly common in modern garbage trucks. These technologies enhance operational efficiency, reduce fuel consumption, and enable real-time monitoring of waste collection activities. As municipalities seek more efficient and cost-effective waste management solutions, the incorporation of these technologies becomes a crucial aspect of garbage collection vehicles.

Global trends in waste management practices also impact the market dynamics of garbage collection vehicles. The shift towards circular economy principles, recycling initiatives, and the reduction of landfill dependency drive the demand for specialized vehicles capable of handling diverse waste streams. Manufacturers are responding by developing versatile and adaptable garbage trucks to meet the evolving needs of waste management systems around the world.

In conclusion, the market dynamics of the garbage collection vehicle industry are shaped by a complex interplay of factors including regulatory frameworks, economic conditions, competition, technological advancements, and evolving waste management practices. The industry is witnessing a transformative phase with a strong emphasis on sustainability, innovation, and efficiency. As the global community continues to prioritize environmentally conscious solutions, the garbage collection vehicle market is likely to see continued evolution and growth in the years to come.

Leave a Comment