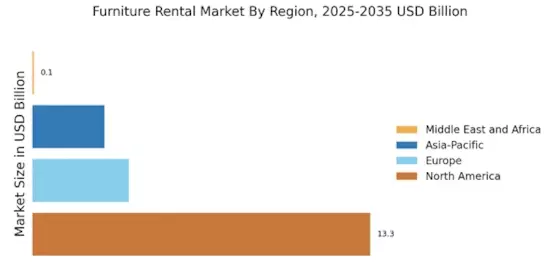

North America : Market Leader in Rental Services

North America is the largest market for furniture rental, driven by urbanization, a growing gig economy, and a shift towards flexible living arrangements. The U.S. holds approximately 70% of the market share, with Canada following at around 15%. The furniture rental market in the US remains highly mature, supported by strong demand from corporate housing, students, and short-term residential leasing. The furniture rental market size US continues to expand due to rising housing mobility and increasing preference for subscription-based furnishing solutions. Regulatory support for rental services and sustainability initiatives further boost demand, making this region a key player in the global market. The competitive landscape is characterized by major players such as CORT, Rent-A-Center, and Brook Furniture Rental Market, which dominate the market with extensive service offerings. The presence of innovative startups like Feather and Furnishr is also notable, catering to younger consumers seeking stylish and affordable solutions. This dynamic environment fosters continuous growth and adaptation to consumer preferences.

Europe : Emerging Market with Growth Potential

Europe is witnessing a significant rise in the furniture rental market, driven by increasing mobility among young professionals and a growing trend towards sustainable living. The region holds approximately 20% of the global market share, with Germany and the UK being the largest contributors, accounting for nearly 10% each. The furniture rental market UK is supported by sustainability initiatives, growing rental housing demand, and increasing consumer awareness of circular economy practices. Regulatory frameworks promoting circular economy practices are catalyzing this growth, making rental services more appealing to consumers. Leading countries in this market include Germany, the UK, and France, where established companies and new entrants are competing vigorously. Key players like IKEA and local startups are innovating to meet diverse consumer needs. The competitive landscape is evolving, with a focus on technology integration and customer experience, positioning Europe as a promising market for future investments.

Asia-Pacific : Rapid Growth in Emerging Markets

The Asia-Pacific region is rapidly emerging as a significant player in the furniture rental market, driven by urbanization, rising disposable incomes, and a growing middle class. Countries like China and India are leading this growth, collectively holding about 15% of the global market share. The increasing trend of renting over buying, especially among millennials, is further supported by favorable government policies promoting rental services. China is at the forefront, with a burgeoning startup ecosystem that includes companies like Rento and Furnish. India is also witnessing a surge in demand, with local players adapting to consumer preferences for affordable and stylish furniture. The competitive landscape is characterized by both established brands and innovative startups, creating a vibrant market environment that is poised for continued expansion.

China is at the forefront, with a burgeoning startup ecosystem that includes companies like Rento and Furnish. India is also witnessing a surge in demand, with local players adapting to consumer preferences for affordable and stylish furniture. The competitive landscape is characterized by both established brands and innovative startups, creating a vibrant market environment that is poised for continued expansion.

Middle East and Africa : Untapped Potential in Rental Market

The Middle East and Africa region presents untapped potential in the furniture rental market, driven by increasing expatriate populations and a growing trend towards temporary living arrangements. The region holds approximately 5% of the global market share, with the UAE and South Africa being the largest markets. Regulatory initiatives aimed at promoting rental services are beginning to take shape, encouraging growth in this sector. In the UAE, the presence of key players like Lounge Lizard and local startups is fostering competition and innovation. South Africa is also seeing a rise in demand for rental services, particularly among urban dwellers. The competitive landscape is evolving, with a focus on affordability and convenience, positioning the region for future growth as consumer preferences shift towards rental solutions.